VeChain Rebranded logo and colours.

- VeThor (VTHO) is the gas token of the VeChainThor blockchain, ensuring stable transaction costs through a dual-token model where VET generates VTHO over time.

- Upcoming 2025 tokenomics changes will shift VTHO issuance to active network participants and staked VET, enhancing sustainability and ecosystem growth.

The blockchain landscape is filled with networks that rely on a single native token for all functionalities, but VeChain stands out with its innovative dual-token model. At the heart of this system lies VeThor (VTHO), a gas token designed to facilitate transactions on the VeChainThor blockchain. This unique structure offers predictability, stability, and efficiency, making it an attractive option for businesses and developers alike.

The Dual-Token Model: VET vs. VTHO

Unlike other Layer 1 blockchains such as Ethereum and Solana, where the same token is used for both transaction fees and value transfer, VeChain separates these roles.

- VET (VeChain Token): Functions as the store of value and is used for staking and governance.

- VTHO (VeChain Thor Energy): Used exclusively for gas fees, ensuring predictable transaction costs.

This approach is particularly beneficial for businesses, as it provides stability in transaction costs, avoiding the volatility often associated with blockchain gas fees.

How Does VTHO Work?

VTHO is continuously generated by holding VET, at a rate of 5.10⁻⁹ per second per VET token. For instance, a wallet holding 10,000 VET would generate approximately 4.32 VTHO every 24 hours. Unlike capped-supply tokens, VTHO has no maximum limit, as its issuance is directly linked to the amount of VET in circulation.

When transactions occur on the VeChainThor blockchain, VTHO is required to process them. The transaction cost is determined by multiplying the gas required with the constant gas price (1.10⁻⁵ VTHO). To prevent inflation, 70% of used VTHO is burned, while the remaining 30% is rewarded to authority master nodes responsible for validating transactions.

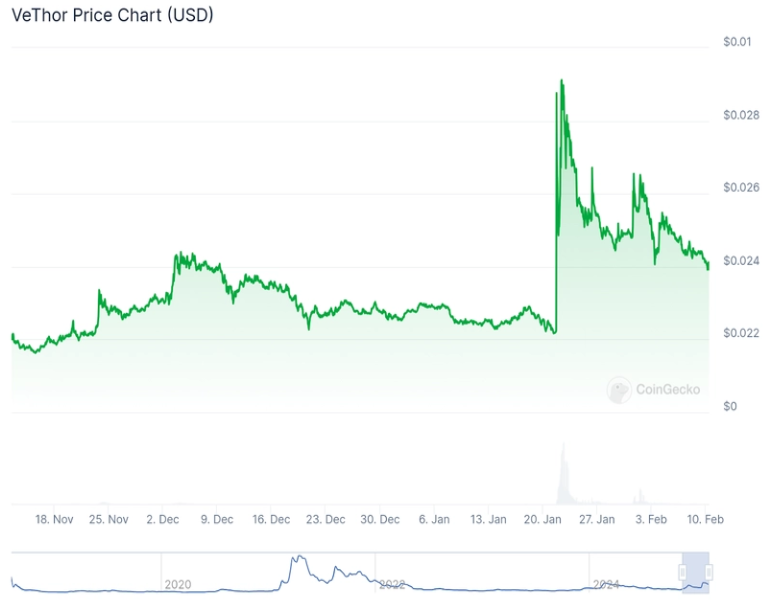

VTHO’s Market Performance

Since its launch in 2018, VTHO has experienced a largely stable price, fluctuating between $0.0003 and $0.0006 for over two years. However, during the 2021 crypto bull run, its price surged to $0.023 before declining during the subsequent bear market. In early 2025, VTHO saw a significant increase in value, surging over 300% following its listing on the Korean exchange Upbit, reaching a trading price of $0.005.

Future Developments: A New VTHO Tokenomics Model

In December 2024, the VeChain team announced a major overhaul of VTHO’s tokenomics to enhance network sustainability. The key changes include:

- Eliminating passive VTHO generation: Instead of being uniformly distributed to VET holders, VTHO will be issued only to active network participants.

- Dynamic issuance linked to staked VET: VTHO generation will be based on the number of VET actively staked, ensuring a more efficient and fair distribution.

- Incentives for key contributors: Validators, economic nodes, and developers building on the network will receive VTHO rewards, fostering growth and adoption.

The Roadmap Ahead

The new VTHO model will be introduced in phases:

- Galactica (Q1–Q2 2025): Implementation of a dynamic gas fee model and Shanghai EVM upgrade.

- Hayabusa (Q3–Q4 2025): Full transition to the new VTHO tokenomics structure.

Conclusion

VTHO plays a crucial role in ensuring the stability and efficiency of the VeChain ecosystem. With its predictable gas costs, innovative burn mechanism, and upcoming tokenomics revamp, VeThor is poised to make a significant impact in 2025 and beyond. As VeChain continues to evolve, VTHO remains a key component in driving its adoption and long-term success.