Ethereum transitioned from PoW to PoS with the Merge (Sept 15, 2022), ushering in staking on the Consensus Layer (formerly Ethereum 2.0) . Version 2.2 introduces infrastructure upgrades—like raising the validator cap to 2 048 ETH—to improve scalability and performance .

Key benefits:

- Earn passive ETH rewards (~3–6 % APY as of mid‑2025)

- Contribute to network security and decentralization

How Ethereum 2.2 Staking Works

- Become a Validator

Deposit 32 ETH in the consensus-layer staking contract - Validator Duties

- Block proposals and attestations by randomly selected validator committees.

- Epochs & slots: 32 slots (~6.4 min total), grouped into epochs. Finality occurs after 2 epochs.

- Rewards & Penalties

- Rewards split: ~12.5 % proposer, ~87.5 % attesters .

- Rewards depend on effective balance and total staked ETH .

- Penalties/slashing for downtime or malicious acts; rare but serious

Reward Rates & Yield Drivers

- Typical APY Range: ~3–6 %

- ~3 % baseline without MEV; up to ~5.7 % with MEV‑Boost

- Factors:

- Total ETH staked (higher total = lower individual rewards)

- Participation rate and validator performance

- MEV‑Boost enhancements

Ways to Stake ETH

Solo Validator (32 ETH)

- Full control, max rewards—but requires hardware, network uptime.

- Hardware needs ~4 GB RAM, SSD, stable internet; costs ~$800–1 500.

- Must run consensus + execution clients (e.g. Lighthouse, Geth).

Staking Pools & Services

- Platforms like Lido, Rocket Pool, and KuCoin’s ksETH staking .

- Lower entry minimums (e.g., 0.01 ETH), liquid tokens (WBETH, ksETH, cbETH).

- Ideal for non‑technical users; provider fees reduce yield.

Centralized Exchanges

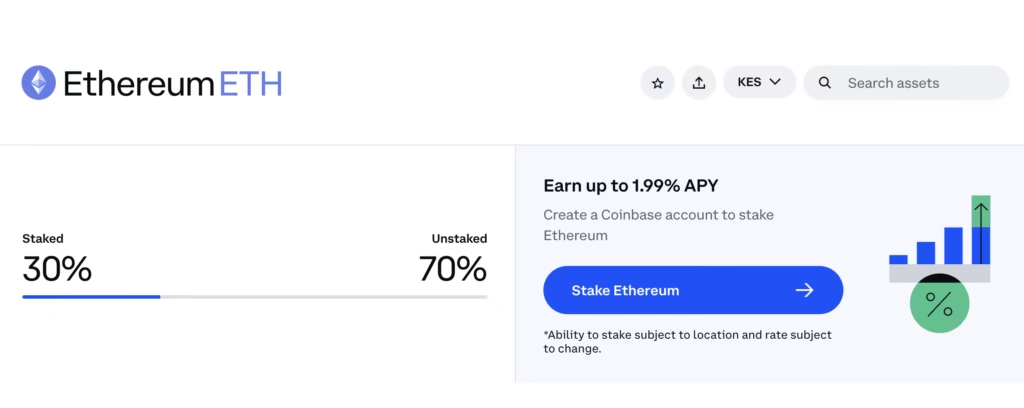

- Coinbase offers ~1.97 % APY with ~30 % of ETH staked .

- Binance, KuCoin offer tokenized staking (WBETH, ksETH) with compounding rewards .

Step-by-Step: Solo Validator Setup

- Prepare environment: clean OS; backup keystore/offline.

- Install clients:

- Execution: Geth or Nethermind

- Consensus: Lighthouse, Prysm, Teku

- Generate keys via the deposit CLI or hardware wallet .

- Send 32 ETH to the deposit contract.

- Start clients, enable MEV‑Boost if desired.

- Monitor node health and uptime.

Common Risks & Considerations

| Risk | Description |

|---|---|

| Slashing | Mistakes or malicious behavior result in losing part/all ETH |

| Downtime | Missing attestations yields small penalties |

| Liquidity | Solo withdrawal delays; pooled staking may offer instant liquidity via tokens like ksETH/WBETH |

| Technical | Requires maintenance, digital security; hardware & power stability essential |

Tax & Compliance Insights

Staking yields are treated as taxable income (fair market value at receipt date) . Withdrawals may trigger capital gains reporting. The audience should consult a local tax advisor.

Frequently Asked Questions (FAQ)

Ethereum 2.2 staking refers to locking up ETH to support the Proof-of-Stake (PoS) network, earn rewards, and help secure the Ethereum blockchain. Version 2.2 includes performance upgrades like raising the validator cap to 2,048 ETH per node.

You need exactly 32 ETH to run a solo validator. This gives you full control and the highest potential rewards, but requires technical setup and maintenance.

Yes. You can use staking pools (e.g., Lido, Rocket Pool) or centralized exchanges (e.g., Coinbase, Binance) to stake smaller amounts, sometimes as low as 0.01 ETH.

As of mid-2025, ETH staking rewards range between 3%–6% APY, depending on MEV usage, total ETH staked, validator performance, and platform fees.

MEV-Boost (Maximal Extractable Value) is an enhancement that allows validators to earn extra revenue from block builders. It can increase APY from a base ~3% to up to ~5.7%.