- Bitcoin dropped after a cooler-than-expected U.S. inflation report, triggering declines across Ethereum, XRP, and Dogecoin.

- Despite short-term losses, analysts remain optimistic about a strong recovery later in 2025.

Cryptocurrency markets stumbled following the latest U.S. inflation data, with Bitcoin, Ethereum, XRP, and Dogecoin all experiencing price pullbacks. Despite initial optimism from a slightly cooler Consumer Price Index (CPI) reading, a wave of market corrections has taken hold—leaving investors puzzled.

Cooling CPI Fails to Spark Bitcoin Rally

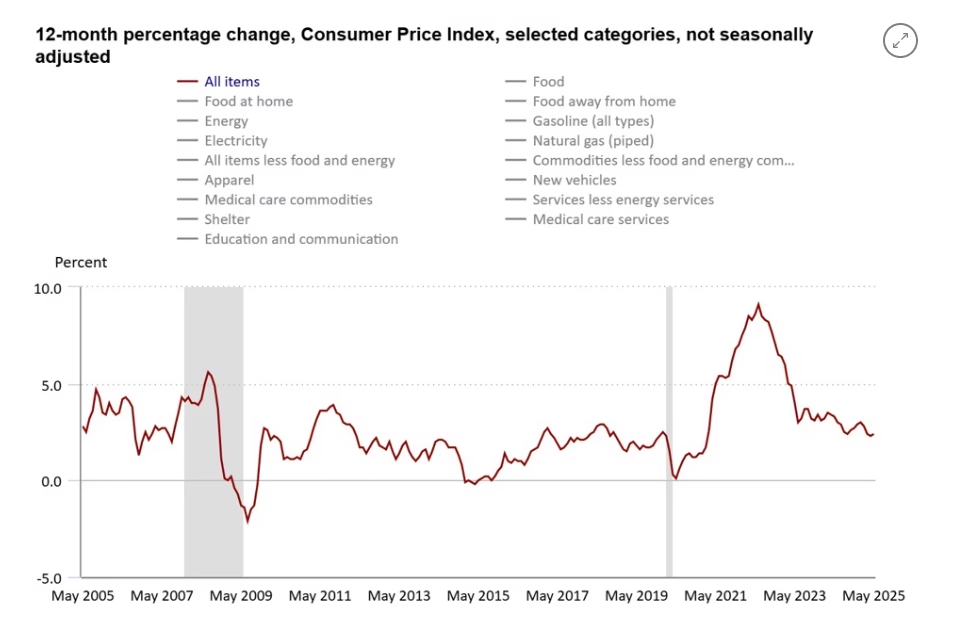

The U.S. CPI report showed annual inflation at 2.4%, just under the expected 2.5%.

At first glance, this encouraged bullish sentiment. Bitcoin surged past $110,000 before falling to $107,634, a 1.4% drop. Ethereum followed a similar trajectory, testing $2,878 but slipping back to $2,750. While inflation appeared to be easing, broader macroeconomic concerns—like stalled U.S.-China trade negotiations—quickly turned optimism into caution.

Massive liquidations intensified the situation. In the past 24 hours, over $683 million in crypto futures were wiped out, mostly from long positions. This surge in selling pressure pushed Bitcoin below $107K and triggered similar losses across major altcoins.

XRP and Dogecoin Hit by Broader Market Sentiment

XRP dropped to $2.23 after briefly reaching a two-week high. Ongoing regulatory uncertainty continues to drag the token down, despite a possible positive legal resolution expected by June 16. If favorable, experts predict XRP could target $0.80 or more.

Dogecoin also lost ground, slipping to $0.19. Technical analysis points to ongoing weakness, with the $0.25 mark acting as strong resistance. Unless sentiment shifts, Dogecoin could revisit the $0.15 zone in the near term.

Still Bullish in the Long Run?

While the short-term correction is evident, long-term forecasts remain optimistic. Analysts project Bitcoin could climb as high as $150,000–$250,000 by year-end, citing a strong imbalance between mined supply and global ownership. Ethereum is also expected to rebound to $2,900 or even hit $3,000 by July, especially if summer trading volumes increase.

Despite current volatility, historical trends suggest resilience in the crypto sector. Previous downturns have been followed by robust rebounds. For patient investors, the recent dip may present more of an opportunity than a warning.

The crypto sell-off stems from a mix of macroeconomic uncertainty, high leverage, and investor caution. However, with strong fundamentals and bullish long-term forecasts, the current downturn may simply be a pause before the next leg up.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.