- Hedera (HBAR) faces a significant price decline, nearing its lowest point in eight months amid strong bearish signals from technical indicators.

- Trader activity in HBAR’s futures market has notably decreased, exacerbating concerns over its short-term outlook.

Hedera (HBAR) has encountered a significant downturn recently, marking a staggering 31% decline over the past week. This downturn places the cryptocurrency perilously close to its lowest point in eight months, raising concerns among investors and analysts alike.

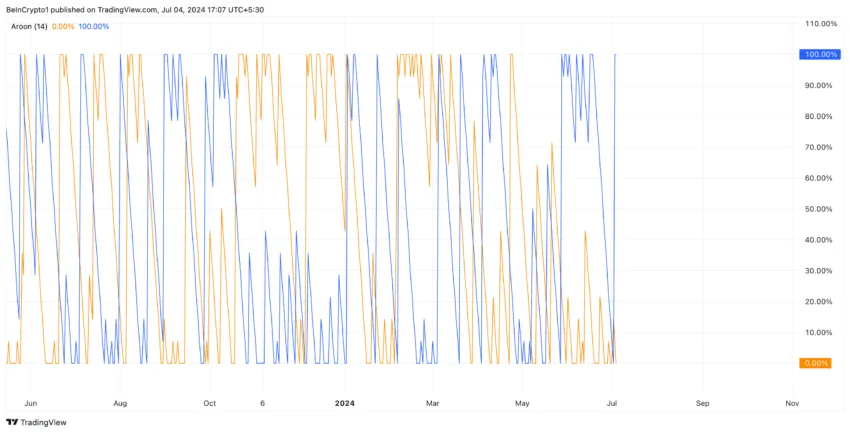

Aroon Indicator Signals Deepening Downtrend

The Aroon Indicator, a key technical tool used to gauge trend strength, paints a bleak picture for HBAR. Currently, the Aroon Down Line stands at 100%, indicating a robust bearish trend. This suggests that sellers are firmly in control, with little sign of a reversal in the near term. Conversely, the Aroon Up Line languishes at 0%, underscoring the absence of any meaningful upward momentum.

Decline in Futures Open Interest Reflects Waning Trader Confidence

In tandem with its price decline, HBAR has also witnessed a significant drop in its futures open interest. This metric, which measures outstanding futures contracts yet to be settled, has plummeted by 27% over the past month. From a year-to-date peak of $147 million in April, HBAR’s futures open interest now stands at $38 million. Such a decline signals diminishing trader participation in the derivatives market, indicative of waning confidence in the cryptocurrency’s short-term prospects.

Chaikin Money Flow (CMF) Suggests Further Losses

Currently trading at $0.069, HBAR faces additional pressure as indicated by its negative Chaikin Money Flow (CMF). This metric, which tracks the flow of money in and out of an asset, confirms a bearish sentiment. With a negative CMF, market liquidity is drying up, paving the way for potential further declines. Analysts foresee HBAR potentially revisiting the $0.057 mark, according to Fibonacci retracement levels, should current trends persist.

Hedera (HBAR) finds itself at a critical juncture as it contends with a pronounced downtrend. With technical indicators pointing firmly southward and a weakening derivatives market, the cryptocurrency faces an uphill battle to regain investor confidence. As traders brace for potential further declines, all eyes remain on whether HBAR can stem the tide and find support to avoid further losses in the competitive cryptocurrency landscape.

This analysis underscores the volatility inherent in the digital asset market, where price movements can be swift and substantial, necessitating a cautious approach for investors navigating turbulent waters.