- Ethereum is trading above $2,400 and testing key resistance at $2,500, backed by strong ETF inflows totaling $322 million.

- However, bearish signals in the futures market and a negative funding rate create short-term uncertainty despite signs of a technical recovery.

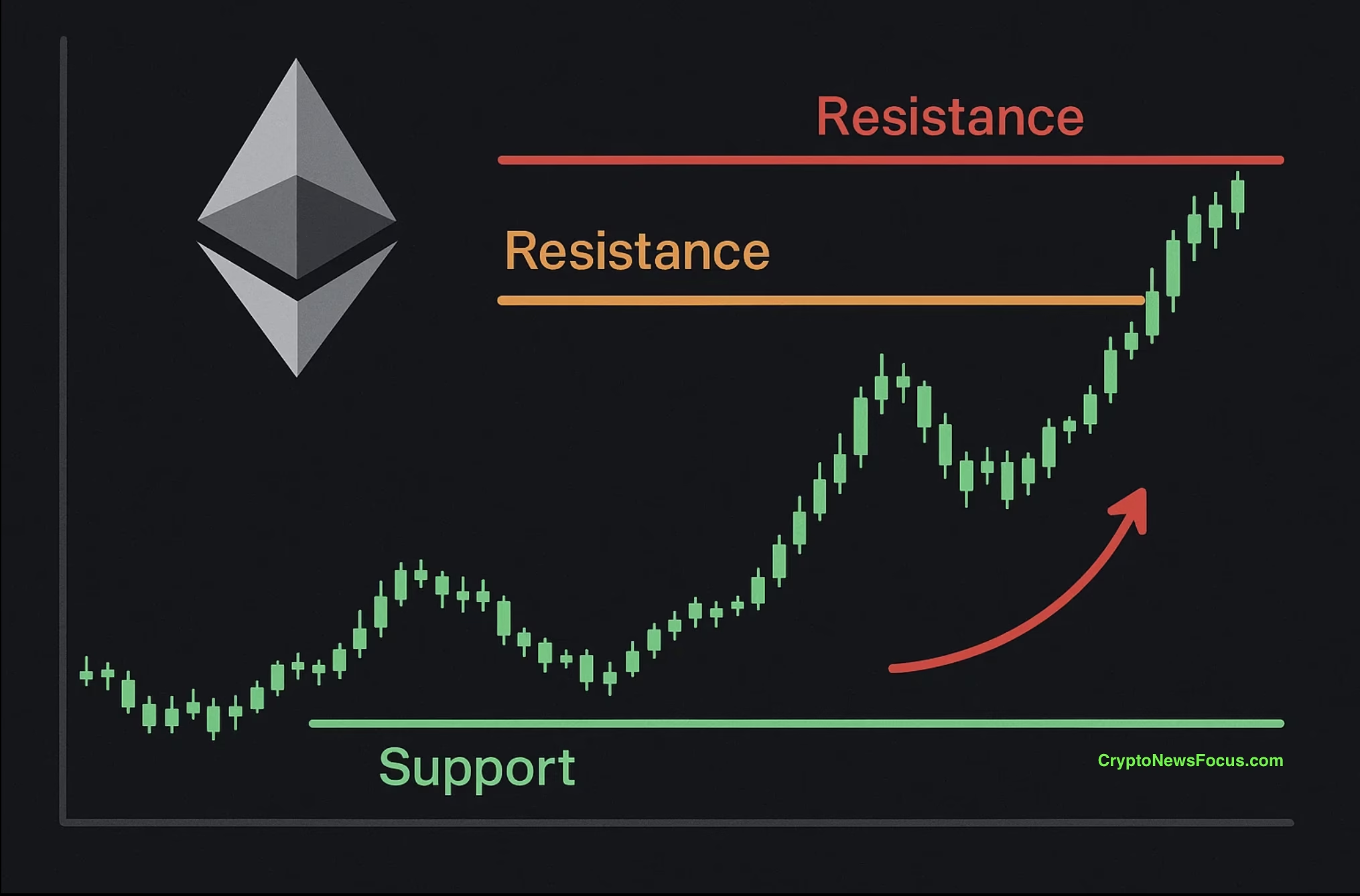

Ethereum (ETH) is navigating a critical juncture as it trades just above $2,400 and faces heavy resistance near $2,500. The second-largest cryptocurrency has climbed over 15% from its recent low of $2,100, with a 1.3% daily gain showing signs of recovery. However, traders are approaching cautiously as market indicators flash mixed signals about its next move.

Weak Futures Demand Clouds Bullish Case

Despite the recent price uptick, derivatives data hints at underlying weakness. Ethereum’s perpetual futures funding rate has flipped negative, sitting at -2%—a steep drop from +10% just two weeks prior. This suggests waning demand for bullish leveraged positions. Bears are now willing to pay bulls to hold shorts, indicating hesitation about ETH’s ability to reclaim higher ground above $2,500.

Moreover, the options market remains neutral, with delta skew indicators hovering between -5% and 5%. This signals a lack of urgent demand for downside protection, suggesting institutions are waiting before making significant directional moves.

Institutional Confidence in Ethereum Remains Strong

While short-term technicals may be unclear, Ethereum continues to enjoy strong institutional interest. In the two weeks following its rejection at the $2,800 level on June 11, ETH-based ETFs attracted $322 million in net inflows. This reflects long-term confidence in Ethereum’s ecosystem—even amid price volatility.

Regulatory developments remain a wildcard. The SEC’s stance on in-kind redemptions and native staking for ETH ETFs could influence future inflows. According to Bloomberg analyst James Seyffart, a key regulatory milestone in late August may be pivotal for Ethereum’s institutional adoption.

Technical Outlook: Make or Break at $2,500

Ethereum’s recent rally has brought it to a major resistance confluence zone at $2,450–$2,500, where the 50 and 100-period SMAs intersect. A breakout here could push ETH to $2,720 or even $2,800, targeting previous highs. However, rejection could send prices back to the $2,310 support zone.

While ETF inflows and a strong rebound from $2,100 suggest growing support, bearish signals in the futures market advise caution. A decisive break above $2,550 could confirm a bullish shift, but until then, Ethereum’s short-term path remains uncertain.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.