- Stellar (XLM) has strong fundamentals, real-world utility, and institutional partnerships that position it as a potential top 10 cryptocurrency in 2025.

- However, it must overcome tough competition, limited retail interest, and slower ecosystem growth to achieve this milestone.

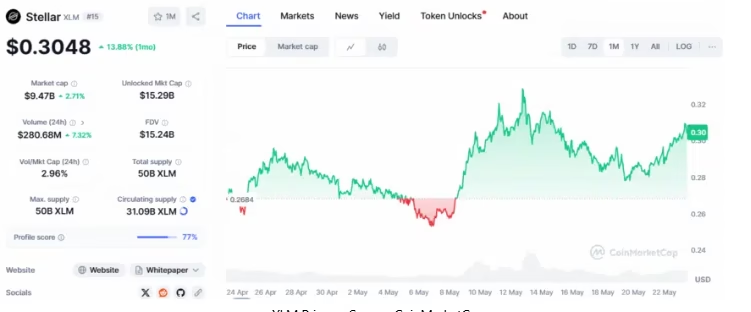

Stellar (XLM) is emerging as a serious contender in the altcoin space. Currently ranked 15th by market cap and trading near $0.30, XLM has the technical backing and strategic partnerships to aim higher—but does it have what it takes to break into the top 10?

ALSO READ:How Cardano Blockchain Works, A Complete Guide

Stellar XLM’s Strengths: What Fuels Its Growth?

Stellar was created in 2014 with a clear mission—to facilitate low-cost, fast cross-border payments. Its native token, XLM, is designed to connect financial institutions with underserved global populations. Backed by key partnerships with major players like IBM and MoneyGram, Stellar offers real-world utility that’s rare in the volatile crypto space.

Several factors are driving XLM’s growth:

- Institutional adoption: Collaborations with financial giants boost credibility and token demand.

- Technological upgrades: Continuous improvements to scalability and speed keep Stellar competitive.

- Regulatory compliance: Unlike rival XRP, Stellar’s proactive regulatory stance appeals to institutional investors.

- Tokenization capabilities: Stellar’s support for real-world asset tokenization adds versatility to its use cases.

- Inflation hedge: In uncertain economies, XLM is viewed as a store of value, drawing new investors.

The Climb to the Top 10: What Needs to Change?

Despite strong fundamentals, Stellar’s journey to the top 10 is far from guaranteed. Currently, XLM has a $9.4 billion market cap. To break into the top 10, it must more than triple, exceeding $30 billion. Experts predict a 2025 price range between $0.39 and $0.80, with bullish cases targeting $1.41 if adoption rises sharply.

Here’s what Stellar must overcome:

- Tough competition: XRP, Cardano, solana, and others have wider ecosystems and stronger communities.

- Limited retail attention: Unlike memecoins, Stellar lacks viral traction among casual investors.

- Slow ecosystem growth: dApps, DeFi, and NFTs haven’t flourished on Stellar like on Ethereum or solana.

- High token concentration: A small number of wallets hold most of XLM, raising centralization concerns.

Stellar stands on a solid foundation built on utility, trust, and institutional interest. However, to enter crypto’s elite ranks, it must accelerate ecosystem development and attract retail investors. With the right innovations and momentum in 2025, XLM could move closer to the top—but it won’t be easy.

ALSO READ:XRP Hits Wall Street with Nasdaq Launch of XRPI and XRPT ETFs

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.