- The upcoming SEC meeting on April 3 could determine whether XRP stabilizes above $2 or faces further declines, as investors await clarity on its regulatory status.

- A positive outcome, such as ETF approval or recognition as a non-security, could drive XRP’s price higher, while ongoing uncertainty may push it lower.

XRP’s Struggle to Stay Above $2

XRP investors are on edge as the Securities and Exchange Commission (SEC) prepares for a closed-door meeting on April 3. The cryptocurrency has been struggling to maintain its position above $2, and the outcome of this meeting could determine whether XRP stabilizes or sinks further.

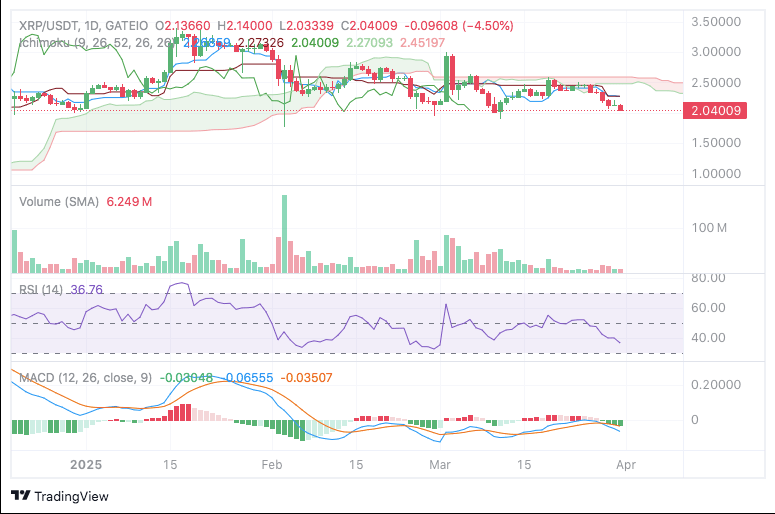

XRP has been fluctuating between $1.95 and $2.10 over the past few weeks, with the current price hovering around $2.06 after a recent 5% decline. Technical indicators paint a bearish picture—XRP’s Relative Strength Index (RSI) stands at 37, signaling increased selling pressure. Additionally, XRP’s price remains below key moving averages, including the 50, 100, and 200 EMAs. The 200 EMA at $1.94 serves as the final support level, and a drop below this point could send XRP tumbling to $1.85 or lower.

What’s at Stake in the SEC Meeting?

The SEC’s upcoming meeting will address critical regulatory and legal matters, sparking speculation on XRP’s future. Ripple’s prolonged legal battle with the SEC centers around whether XRP should be classified as a security. A recent settlement saw Ripple paying $50 million, significantly lower than the expected $115 million. Investors hope for positive news, such as the approval of an XRP-spot exchange-traded fund (ETF) or a declaration that XRP is not a security. These developments could boost investor confidence and drive prices higher.

As the SEC meeting approaches, investors remain hopeful yet cautious. The outcome could either validate XRP’s potential or deepen its struggles. All eyes are on April 3 as the crypto world awaits a verdict that could reshape XRP’s future.