- Stellar (XLM) has surpassed Bitcoin Cash (BCH) in market value.

- Real-world use and ETF inclusion fuel Stellar’s rise. It now ranks above Bitcoin Cash in market value.

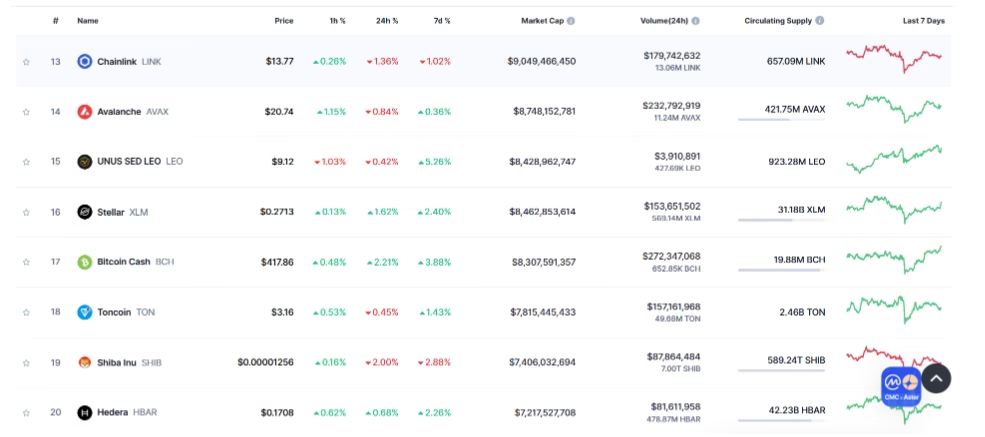

Stellar (XLM) has officially overtaken Bitcoin Cash (BCH) in a noteworthy market reshuffle, claiming the 16th spot in global cryptocurrency rankings at press time. With a market capitalization of $8.4 billion, Stellar now edges out BCH, which stands at $8.25 billion, according to CoinMarketCap data.

ALSO READ:Ethereum Tests Critical Support as Institutional Demand Grows

Stellar’s Real-World Strategy Pays Off

Unlike many legacy cryptocurrencies, Stellar’s rise isn’t driven solely by speculation. The project has steadily positioned itself as a leader in blockchain-based financial infrastructure. It now supports cross-border payments in over 70 countries, having processed billions of transactions globally.

With $17 billion in transaction volume and $522 million worth of assets currently on-chain, Stellar has become one of the most trusted platforms for real-world asset (RWA) tokenization. This foundation has enabled it to emerge as a key player among top blockchains handling tokenized financial assets.

Nasdaq ETF Adds Stellar (XLM), Strengthening Its Market Credibility

A significant driver of recent investor confidence in Stellar came with Nasdaq’s reconstitution of its Crypto U.S. Settlement Price Index. The move led to Stellar being added to the Hashdex Nasdaq Crypto Index U.S. ETF, alongside major digital assets like bitcoin (BTC), ethereum (ETH), solana (SOL), cardano (ADA), and XRP. This institutional recognition bolsters Stellar’s long-term appeal and attracts more capital inflows.

ALSO READ:Dont be Scammed! 10 fake Airdrops you should avoid

The Road Ahead for Stellar

As Stellar climbs higher in the rankings, market watchers are keen to see whether it can maintain its momentum and potentially rise further. Optimizations to its smart contract platform, Soroban—including improvements like concurrency, aggressive caching, and ahead-of-time compilation—aim to improve performance and scalability.

What About Bitcoin Cash?

Bitcoin Cash remains within the top 20 despite losing its position. It continues to show resilience amid market volatility. A potential uptick in buying pressure could still push BCH upward, keeping it in contention in the competitive crypto landscape.

For now, Stellar’s consistent performance, increasing real-world utility, and rising institutional interest mark a shift in investor priorities—from speculative gains to practical blockchain solutions.

ALSO READ:Cardano Targets $1.39 After Holding Key Support Zone

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.