- XRP surged 1.42% after the SEC acknowledged Grayscale’s ETF filing, boosting hopes for an XRP-spot ETF approval.

- Legal clarity from Ripple’s dropped appeal and rising ETF optimism could drive XRP to new highs.

XRP is back in the spotlight after the SEC acknowledged Grayscale’s amended filing to convert its Digital Large Cap Fund into an ETF—one that includes XRP’s among other major altcoins. The news sparked a 1.42% rally in XRP on June 30, outperforming the broader crypto market. Speculation surrounding the possible approval of a U.S.-based XRP-spot ETF has intensified, especially as Grayscale’s fund holds 4.99% XRP, alongside BTC, ETH, SOL, and ADA.

Industry insiders, including Nate Geraci of ETF Store, suggest the approval could serve as a “test run” for expanding ETF exposure beyond bitcoin. Bloomberg analysts now assign a 95% probability that an XRP-spot ETF could be approved by the end of 2025. Meanwhile, Polymarket reflects more conservative odds at 60.2%, down from 98.2% earlier in June.

Legal Developments Could Clear the Path

Another key driver behind XRP’s latest price action is Ripple’s decision to withdraw its cross-appeal in its ongoing legal battle with the SEC. Investors now await confirmation that the SEC will also drop its appeal against the ruling on Ripple’s Programmatic Sales of XRP’s. Such a dismissal could effectively remove a major regulatory barrier, unlocking the potential for XRP-spot ETF approvals.

The final deadline for Grayscale’s ETF decision is due this week, and market participants are watching closely for an announcement that could reshape the altcoin ETF market.

XRP Price Outlook: Key Resistance and Support Levels

After closing at $2.2382, XRP is approaching resistance at the June 16 high of $2.3389. A breakout could signal a move toward the May peak of $2.6553 and, possibly, the January high of $3.3999. On the downside, falling below the 50-day EMA could trigger a retreat to the 200-day EMA, with support near $1.9299.

Bitcoin Drops as XRP’s ETF Buzz and Legal Progress Drive Gains

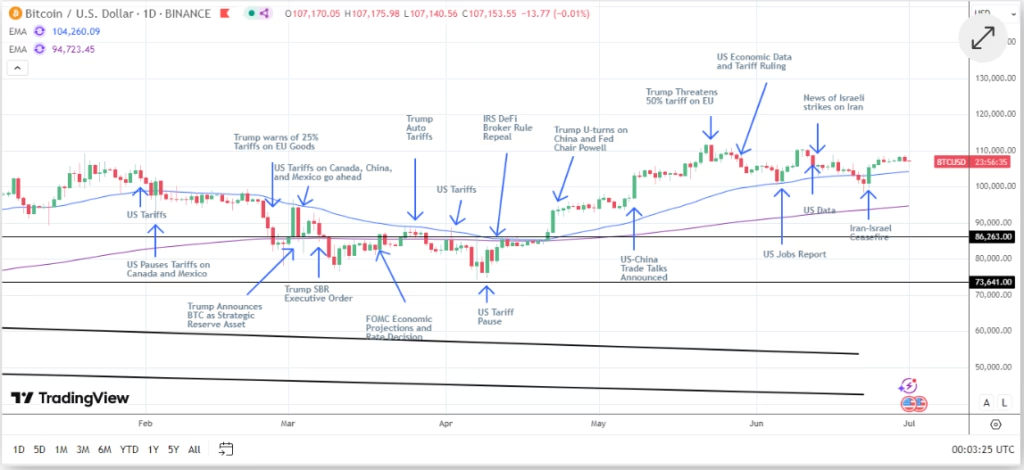

While XRP advanced, bitcoin dipped 1.09% to $107,167, snapping a three-day winning streak. The decline is attributed to profit-taking and cautious sentiment ahead of a key crypto tax vote on Capitol Hill. Still, strong demand for BTC-spot ETFs and diminishing exchange supply signal that long-term bullish trends remain intact.

XRP’s price is responding strongly to growing hopes for ETF approval and legal clarity. With the SEC’s decision and court rulings pending, both XRP’s and BTC remain tightly tied to U.S. regulatory and legislative developments.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.