- XRP has fallen 46% from its all-time high, and while its utility in international payments sets it apart, its price movements have been largely driven by speculation and external events.

- Historical trends suggest that after surges, XRP often faces prolonged declines, making its current dip a risky investment opportunity.

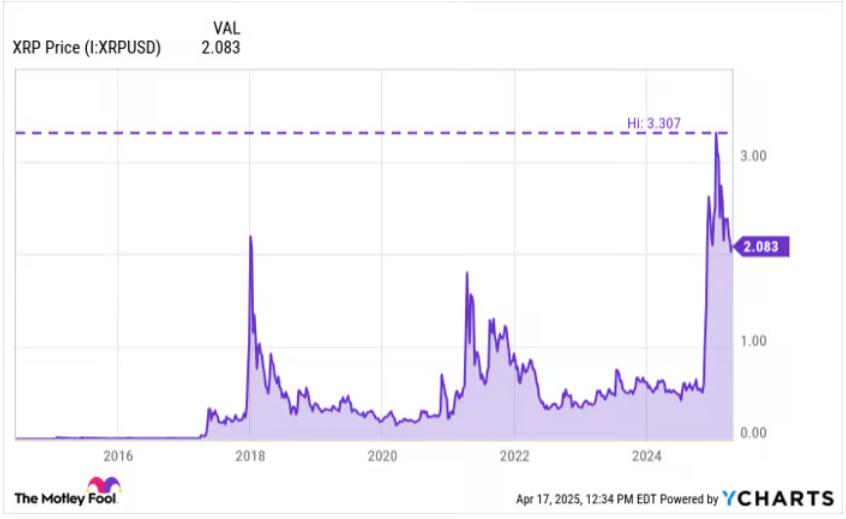

Despite a surge of optimism earlier this year, XRP has taken a sharp turn downward, dropping 46% from its recent all-time high. While some investors may view this dip as a potential entry point, XRP’s historical performance suggests a more cautious approach might be warranted.

XRP: More Than Just Hype

Unlike many tokens in the crypto world that ride waves of speculation, XRP was created with a clear purpose — to revolutionize international payments. Developed by Ripple, it aims to replace sluggish, costly traditional wire transfers with faster and cheaper blockchain-powered alternatives. This real-world use case has long set XRP apart from other coins. Yet, despite its utility, XRP’s price movements seem more tied to speculation and external events than adoption metrics.

The Trump Effect and Regulatory Drama

XRP’s most recent rally aligned closely with Donald Trump’s reelection win and his crypto-friendly rhetoric. Investors seemed hopeful that his presidency would usher in favorable regulations and perhaps a win for Ripple in its long-standing battle with the SEC.

That optimism got a further boost when the SEC dropped its appeal in its case against Ripple. In theory, these should have been strong catalysts. But oddly, XRP’s price has continued to decline since March, suggesting these events may have been fully priced in already — or that deeper concerns remain.

What History Tells Us

XRP has a pattern of dramatic spikes followed by extended periods of stagnation or decline. After its 2018 peak, XRP slid into a prolonged slump. A similar scenario unfolded after a brief recovery in 2021. Now in 2025, history seems to be repeating itself.

While past performance doesn’t guarantee future results, XRP’s tendency to crash after surges should give investors pause. It has shown resilience — but not without painful downturns along the way.

The Bottom Line

XRP’s current price dip may tempt opportunistic investors, but the historical data suggests caution. Regulatory clarity and broader crypto market trends may eventually support a rebound, but for now, XRP’s future remains uncertain.

If you’re considering jumping in, it might be wise to watch from the sidelines until stronger signs of momentum — or more stable support — appear. As always, never invest more than you’re willing to lose in this volatile space.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.