- XRP experienced a massive long liquidation event wiping out positions at a 36,283 percent higher rate than shorts.

- XRP’s sharp sell-off exposed the risks of high leverage in volatile markets.

XRP traders experienced an extraordinary event recently as the cryptocurrency saw an unprecedented liquidation imbalance, wiping out bullish long positions at an astonishing 36,283% higher rate than shorts within just one hour. This sudden sell-off sent shockwaves through the XRP market, highlighting the risks leveraged traders face during volatile price swings.

ALSO READ:Pi Network Frustrates Users with $100M Fund Instead of Promised Ecosystem

A Closer Look at the Liquidation Bloodbath

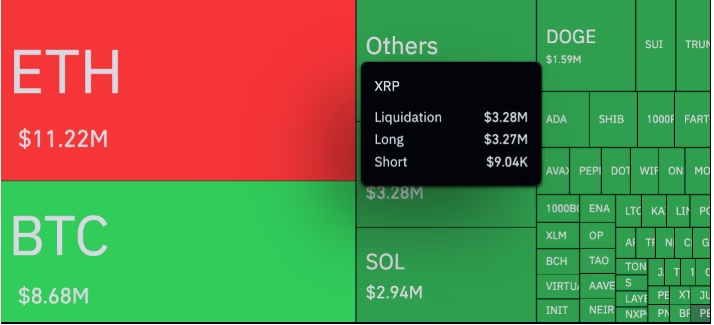

CoinGlass data revealed that traders liquidated $3.27 million worth of XRP long positions during this intense hour, while short liquidations totaled only $9,040. Although the total liquidation volume was not the largest for XRP, the extreme disparity between longs and shorts surprised many bullish traders.

This sharp sell-off appears to have been triggered by a concentrated wave of selling pressure. Most likely, forced liquidations—where leveraged traders are automatically sold out as prices hit stop-loss thresholds—cascaded through the market, accelerating the price drop. The hourly chart at the time showed a rapid sequence of red candles, confirming the sudden bearish momentum.

What This Means for XRP Traders

Although XRP traders have seen liquidations before, the scale and speed of this event were exceptional. According to CoinGlass, this was a short, intense correction primarily impacting overexposed long traders rather than signaling a fundamental shift in the overall market trend for XRP.

Over the past 24 hours, total crypto liquidations reached $671.5 million, with longs making up 69% of the total. While Bitcoin and Ethereum led in liquidation volume, XRP’s extreme hourly imbalance served as a stark reminder of how quickly leveraged positions can turn risky in volatile altcoin markets.

Navigating Volatility in Leveraged Markets

This event highlights the dangers of over-leveraging in the crypto market. Traders using high leverage to amplify gains also amplify their risk, especially in altcoins like XRP that can experience sharp price swings. Automated stop-loss triggers and forced liquidations can create a feedback loop, driving prices down further and causing more liquidations.

For those trading XRP or other volatile assets, caution and risk management remain crucial. Watching key support levels, setting sensible stop-losses, and avoiding excessive leverage can help navigate sudden market shocks like this one.

In summary, XRP’s recent 36,283% liquidation imbalance shows just how intense and fast crypto market corrections can be. While not necessarily signaling a broader market crash, it serves as a strong warning to bulls about the risks lurking in leveraged trading.

ALSO READ:XRP Price Crash to $2.3, Is It the End of the Rally? Here’s What the Chart Reveals