- XRP is testing a key support level amid bearish futures sentiment, but strong long-term holder confidence has helped stabilize its price, keeping it resilient compared to other major cryptocurrencies.

- If XRP holds above support and breaks resistance at $2.72, it could trigger a bullish rally, while failure to do so may push it toward $1.35.

Ripple’s XRP is at a critical juncture as it tests a key support level. Despite prevailing bearish sentiment in the futures market, long-term holders continue to retain their positions, keeping the token’s price relatively stable compared to other major cryptocurrencies.

XRP Investors Stay Strong Amidst Market Uncertainty

XRP has experienced a 1% decline, reflecting the impact of the broader market downturn. However, its long-term holders (LTH) have maintained their positions, with an impressive average profit of 233%, according to Santiment data. This strong holding pattern has likely contributed to the token’s resilience, preventing steeper losses.

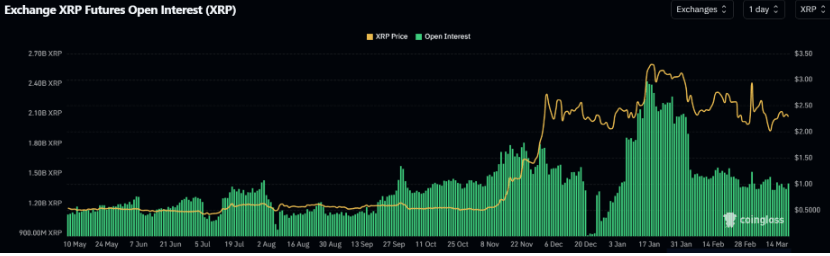

At the same time, XRP futures open interest (OI) has remained stagnant since early February, shedding 33% between February 1 and March 18. A decline in OI typically signals a risk-off sentiment among traders, indicating a cautious approach amid uncertain market conditions.

Bearish Futures Sentiment and Key Support Test

Funding rates in the XRP futures market have been predominantly negative in recent weeks, suggesting that traders are largely taking short positions. This aligns with the overall consolidation phase seen across the broader crypto market.

Despite the bearish outlook, XRP has managed to outperform major assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) over the past week, securing a 3% gain. This divergence suggests that investors remain confident in XRP’s long-term potential, possibly due to expectations surrounding the SEC vs Ripple legal battle, which appears to be approaching a resolution.

Can XRP Hold Above Key Support?

XRP has sustained $7.40 million in futures liquidations in the last 24 hours, with $5.15 million in long positions and $2.25 million in short positions. The token is currently retesting the upper boundary of a descending channel for the third consecutive day.

If XRP successfully holds above this boundary, it could aim for its next major resistance at $2.72. A breakthrough beyond this level might set the stage for a bullish rally, potentially challenging its seven-year high.

However, a failure to maintain support near the $2.00 psychological level could invalidate this bullish outlook, pushing the token toward $1.35. Technical indicators such as the Relative Strength Index (RSI), Stochastic Oscillator (Stoch), and Moving Average Convergence Divergence (MACD) are currently at neutral levels. A decisive move above these levels could indicate a shift in momentum toward a bullish trend.

XRP remains in a pivotal position, with strong long-term holder confidence balancing out the bearish sentiment in the futures market. If it manages to hold key support levels and break through resistance, the token could be poised for significant upside movement. Meanwhile, investors continue to watch the evolving legal battle with the SEC, which could serve as a major catalyst for future price action.