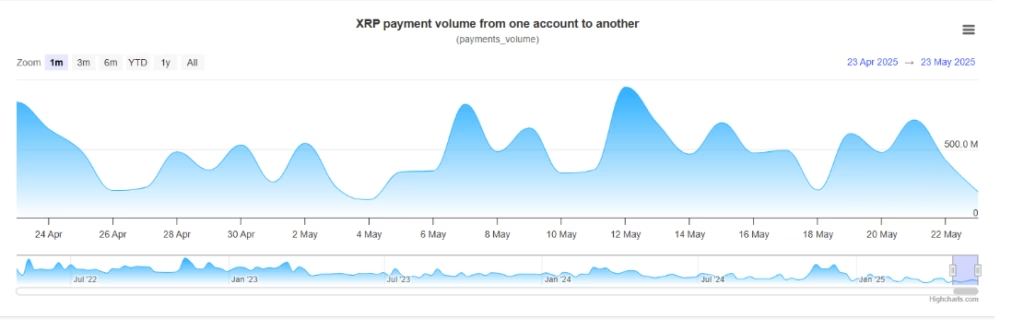

- XRP lost almost 300 million in payment volume in just 24 hours, signaling a sharp drop in network activity.

- XRP’s recent price recovery may struggle to continue without a rebound in real usage.

XRP has hit a concerning milestone, shedding nearly 300 million in on-chain payment volume within just 24 hours. This sudden drop, from over 700 million tokens to approximately 412 million on May 22, comes amid what seemed to be a promising recovery in price action. While XRP has made technical gains, this abrupt decline in real-world usage raises critical questions about the sustainability of its upward trajectory.

ALSO READ:XRP Hits Wall Street with Nasdaq Launch of XRPI and XRPT ETFs

XRP Bullish Breakout Meets Bearish Utility Signals

Earlier this month, XRP broke free from a persistent downward channel, reclaiming several key exponential moving averages — including the 50-day, 100-day, and even the influential 200-day EMA. These signals usually point to a strengthening trend, with XRP consolidating just under the $2.50 mark and finding support near $2.30–$2.35.

However, this price stability stands in stark contrast to its plunging payment volume. For a utility-centric token like XRP, transactional usage is more than a footnote — it’s a fundamental metric of value. The payment volume, which had previously surged above 700 million tokens during price rallies, has now decoupled from price action. This divergence could suggest a decline in institutional activity or waning retail engagement.

Will Technical Support Hold?

As it stands, XRP’s ability to hold the $2.30–$2.35 range could determine its next move. Holding this level might allow the asset to reattempt a climb past $2.60. But if support crumbles, a slide toward $2.15–$2.20 is possible.

Despite the drop in usage, not all indicators are flashing red. The Relative Strength Index (RSI) remains under the overbought threshold and shows no signs of bearish divergence — a sign that another leg up could still materialize, provided utility metrics stabilize or improve.

XRP’s drop in volume serves as a cautionary note for the crypto community, particularly for those tracking payment-based tokens. As market participants increasingly weigh utility over speculation, XRP’s current divergence between price and usage may influence broader investor sentiment.

If XRP is to maintain its relevance in the evolving crypto landscape, a rebound in on-chain activity may be more critical than any chart pattern or technical breakout.

ALSO READ:Kraken Launches xStocks on Solana to Offer Tokenized U.S. Equities Globally

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.