- XRP is poised for a potential 300% rally in March 2025, driven by favorable regulatory developments, strong on-chain indicators, and increased whale accumulation.

- With XRP trading above its 200-day EMA and key resistance levels in sight, a breakout toward $6 seems increasingly likely.

The cryptocurrency market is known for its volatility, and Ripple’s XRP is no exception. As March 2025 approaches, analysts are predicting a significant rally for XRP, with the potential to surge by 300%. But what’s fueling this optimistic forecast? Let’s explore the key factors driving this bullish sentiment.

1. Favorable Regulatory Developments

One of the most significant catalysts for XRP’s potential price explosion is the improving regulatory environment. The U.S. Securities and Exchange Commission (SEC) has been softening its stance on cryptocurrency firms, and legal experts suggest that the long-standing Ripple vs. SEC case could be resolved soon. If XRP secures a favorable outcome, investor confidence could skyrocket, leading to a surge in demand and price.

Moreover, speculation around an XRP Exchange-Traded Fund (ETF) approval is adding to the excitement. The launch of an XRP ETF would open the floodgates for institutional investors, driving higher liquidity and price appreciation.

2. On-Chain Indicators Show Strong Buying Opportunity

Market metrics indicate that XRP is currently in an accumulation phase, which often precedes a bullish breakout. One key indicator, the Market Value to Realized Value (MVRV) ratio, has entered what analysts call the “opportunity zone.”

An MVRV ratio of -11% suggests that the average XRP holder is currently at an unrealized loss. Historically, whenever the MVRV ratio falls into negative territory, it is followed by a price rebound. This pattern was observed in previous rallies, including XRP’s notable uptrend in November 2024.

If history repeats itself, XRP could see a significant price jump as traders take advantage of the current discount.

3. Increased Whale Accumulation

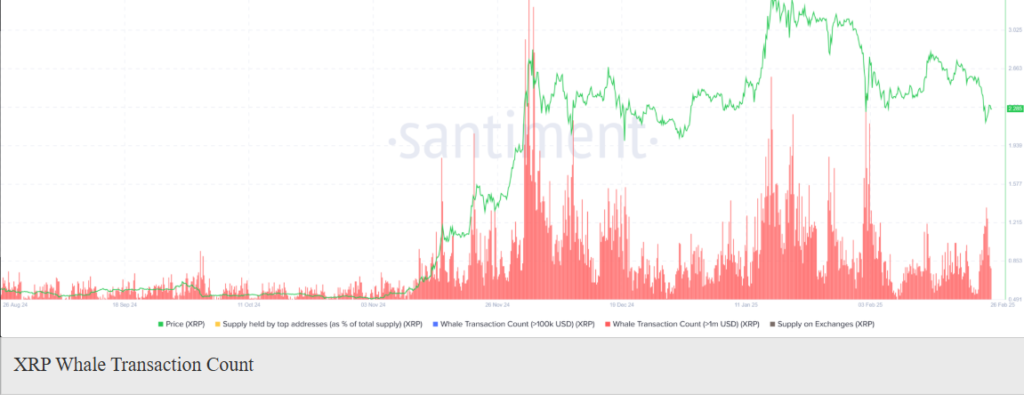

Another bullish signal for XRP is the growing activity among large investors, or “whales.” On-chain data shows a sharp increase in whale transactions, with addresses holding more than 1 million XRP tokens actively accumulating during the recent price dip.

Whale accumulation is often a precursor to a strong rally, as it indicates confidence in future price appreciation. When large investors start buying in bulk, it creates a supply squeeze that drives prices higher.

Technical Strength Supports the Rally

Despite recent market corrections, XRP remains in a long-term uptrend. The token is still trading above its 200-day Exponential Moving Average (EMA), which is a strong technical indicator of sustained bullish momentum. Additionally, volume profile analysis suggests high buying activity at current levels, reinforcing the possibility of a breakout.

Key resistance levels to watch include the Fibonacci retracement levels at $3.41 and $4.43. If XRP manages to break past these barriers, it could set the stage for a rally toward the projected $6 target.

Final Thoughts

XRP’s potential for a 300% rally in March 2025 is backed by multiple bullish factors, including favorable regulatory developments, strong on-chain metrics, and increased whale accumulation. While crypto markets remain unpredictable, the current setup presents a compelling case for XRP’s explosive growth in the coming months. Investors and traders will be watching closely to see if these factors align for a major price surge.