- XRP has fallen to the $3 support level after being rejected at $3.6, with bearish indicators confirming the ongoing correction.

- Although sellers still dominate, declining volume hints at possible exhaustion and a potential reversal ahead.

Ripple’s XRP has taken a bearish turn this week, with the price correcting sharply after rejection at $3.6. The asset now clings to the key $3 support, as market sentiment shifts in favor of sellers. Technical indicators show continued weakness, but some signs suggest the selling pressure could be easing.

XRP Bears Take Control After Rejection at $3.6

After touching $3.6, XRP entered a steep correction marked by lower highs and lower lows. The recent drop pushed the price back to $3—a level that is now acting as critical support. If this level breaks, XRP could fall further toward $2.7, a support not tested since its earlier surge.

Bearish Signals Strengthen for XRP

Both the MACD and RSI have turned bearish, confirming the current downtrend. These technical indicators are making lower lows, signaling that buyers have yet to regain control. The absence of bullish divergence suggests there’s still no clear reversal on the horizon.

Sellers Are Dominating, But For How Long?

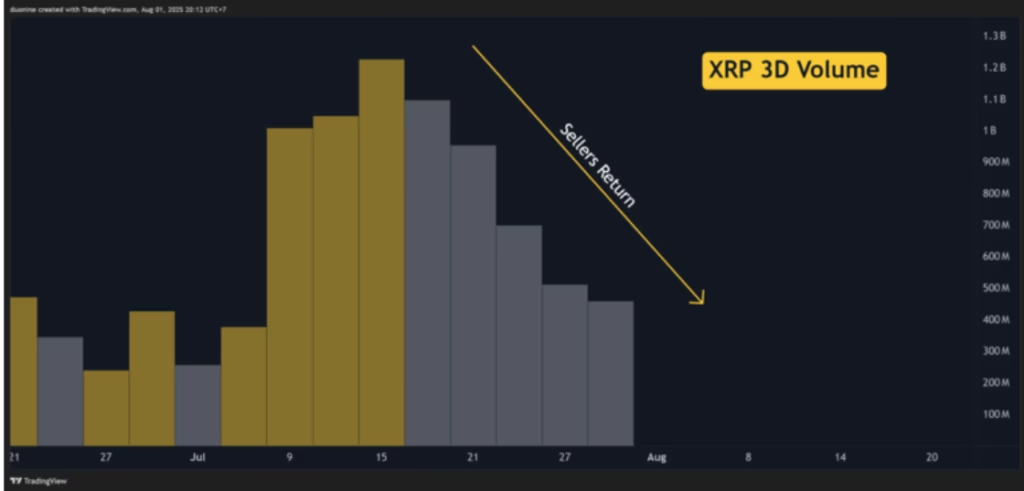

In the past 15 days, XRP has seen five consecutive 3-day red candles, highlighting intense selling pressure. While this trend is unusual following such a strong rally, the volume profile reveals something important: sellers are showing signs of exhaustion. Trading volume is making lower lows, which often precedes a shift in direction.

Outlook: Watch the $3 Support Closely

As of now, XRP’s short-term fate rests heavily on the $3 level. A breakdown below could accelerate losses to $2.7. However, if this support holds and volume from sellers continues to fade, a rebound toward $3.6 or even $4 could be possible in the near future.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.