- XRP is struggling to maintain its uptrend, with declining network activity and bearish technical indicators weighing on its price.

- However, whale accumulation signals potential for a breakout if key resistance levels are overcome.

XRP has faced challenges in sustaining its recent price uptrend, struggling to hold key support levels amid declining network activity and weakening user engagement. The digital asset’s price has hovered around $2.17, showing little movement as it faces pressure from a bearish market sentiment. Here’s a closer look at why XRP is struggling to break through key resistance levels and what might be needed for a rebound.

Declining Network Activity Dampens Sentiment

One of the most concerning factors for XRP’s price action is the notable decline in network activity. According to on-chain data from Santiment, daily active addresses on the XRP Ledger have dropped significantly from a peak of 612,000 in March to just around 40,000 in early May. This dramatic decrease in user engagement suggests waning interest in the token, which typically leads to lower transaction volumes and liquidity. In the past, such drops in activity have often signaled price stagnation or even declines.

Despite the downturn in daily active addresses, XRP’s price has managed to stay above the critical $2.10 support level, but the fading interest may eventually weigh on its recovery potential. As fewer users transact on the network, demand for XRP decreases, which could delay any significant price appreciation in the near term.

XRP Whale Accumulation Signals Potential for Breakout

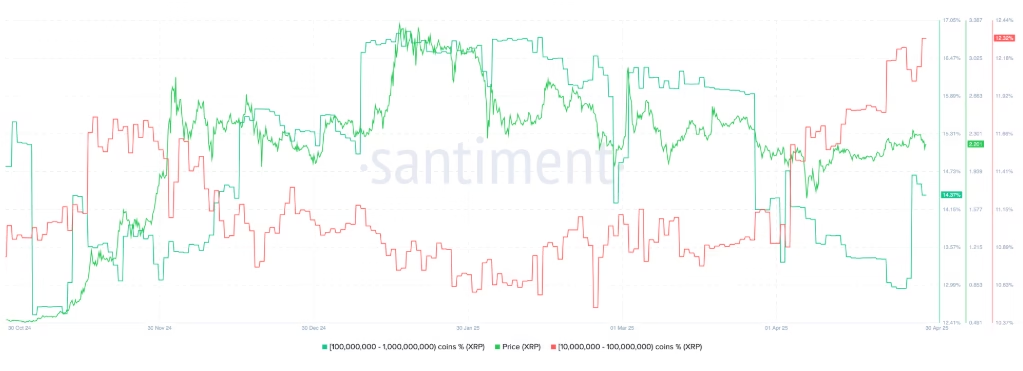

Interestingly, while retail interest may be declining, large investors, or “whales,” have been increasing their holdings of XRP. Since early April, whale cohorts holding between 10 million and 100 million XRP have raised their share of the total supply from 10.91% to 12.32%. This suggests that institutional players and large investors are optimistic about XRP’s long-term prospects. Their accumulation could be signaling an upcoming breakout, possibly in anticipation of positive developments like a potential settlement between Ripple and the SEC or the approval of spot XRP ETFs.

Historically, whales tend to accumulate tokens during periods of consolidation, which often precede price surges. This accumulation could be an early sign that XRP is poised for a rebound, especially if bullish catalysts materialize in the coming months

Technical Indicators: Bears Still in Control

On the technical front, XRP is struggling to regain bullish momentum. The price remains below critical Exponential Moving Averages (EMAs) and the Relative Strength Index (RSI) indicates increasing selling pressure. The RSI is currently below 44, signaling that bearish momentum is still in control. However, its upward trajectory hints at the possibility of a trend reversal if XRP can clear the 50-, 100-, and 200-EMA resistance levels.

If XRP manages to break through these EMAs, it could pave the way for a rally toward the $3.00 mark.However, XRP must break the April high of $2.36 to trigger more substantial bullish movement.. In the short term, key support levels to watch are $2.10, $2.00, and the April 7 low of $1.61.

XRP’s price is at a critical juncture, with declining network activity and bearish technical indicators clouding its short-term prospects. However, the accumulation by large investors and the potential for positive news developments, such as a Ripple-SEC settlement, offer hope for a possible recovery. Traders should closely monitor the asset’s price action around key support and resistance levels, as any decisive moves could signal the next phase in XRP’s price journey.

ALSO READ:Ripple’s Banking License Bid: Could XRP Become a Global Finance Leader?

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. We encourage readers to conduct further research and consult additional sources before making any decisions based on this content.