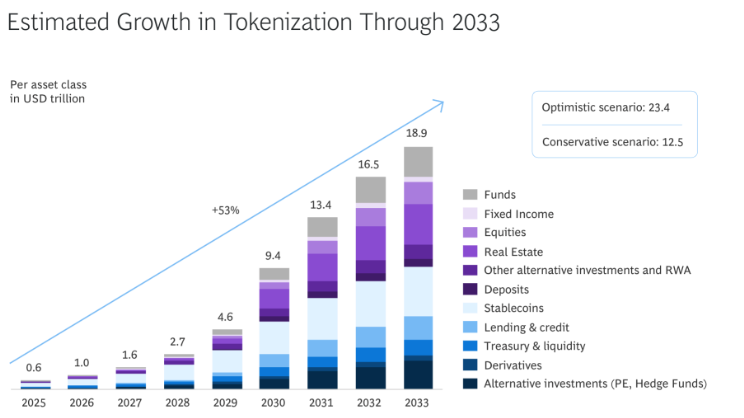

- Ripple is positioning XRP as a key bridge asset in the rapidly growing global tokenization market, which is expected to expand from $0.6 trillion in 2025 to $18.9 trillion by 2033.

- With increasing investor sentiment and institutional adoption, XRP’s role in seamless cross-border payments and settlements is poised for significant growth as the financial infrastructure shifts to a tokenized economy.

The future of global finance is rapidly shifting, with Ripple leading the charge toward the tokenization of real-world assets. A recent Ripple-BCG report projects that the global asset tokenization market will soar from $0.6 trillion in 2025 to an astounding $18.9 trillion by 2033. This growth, driven by a 53% compound annual growth rate (CAGR), is positioning Ripple and its native token, XRP, at the heart of a transformation in the financial landscape.

Tokenization: The Future of Financial Assets

Tokenization, which involves converting real-world assets into digital tokens on a blockchain, is no longer a futuristic concept. What was once limited to cryptocurrencies is now expanding into a wide range of financial instruments, such as securities, property, and funds. These tokens enable fractional ownership, instant settlement, and enhanced regulatory compliance, setting the stage for a revolution in how financial markets operate.

According to the Ripple-BCG report, this shift in the global financial infrastructure is not just technological but also regulatory, as institutions worldwide are beginning to embrace blockchain solutions. Ripple is positioning XRP as a bridge asset in this new tokenized economy, aiming to capitalize on the growing demand for seamless cross-border payments and settlements.

XRP’s Role in the Tokenized Future

As the market for tokenized assets expands, Ripple plans to leverage its XRP Ledger to facilitate frictionless transactions, furthering the adoption of XRP. The United States is at the forefront of this tokenization boom, with the federal government actively pushing for clearer regulations on digital assets, which could accelerate growth in tokenized funds, treasuries, and collateral.

A significant sign of XRP’s bullish potential can be seen in its recent price movements. As of Friday, XRP had reclaimed support above the 200-day Exponential Moving Average (EMA), hovering around the $2.00 mark. This technical structure suggests the bulls are in control, with a short-term target of $2.25 on the horizon, as indicated by the confluence of the 50-day and 100-day EMAs.

The Road Ahead for XRP

Despite some macroeconomic challenges, including tensions between the US and China over tariffs, XRP’s prospects remain strong. The recent surge in open interest to $3.08 billion and the positive long/short ratio suggest that investor sentiment is increasingly bullish, with more traders eyeing XRP for exposure.

Ripple’s focus on tokenization and its role in reshaping global finance puts XRP in an excellent position for long-term growth. As the tokenization market reaches its tipping point, early movers, including financial institutions, are looking to leverage XRP as a bridge asset to a more efficient, decentralized economy. The future of XRP is indeed bright as it rides the wave of this monumental shift in the financial sector.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.