- XRP faced a major technical rejection at the 26-day EMA, preventing a breakout above $2.42 and strengthening bearish control, with low trading volume further weakening bullish attempts.

- If the $2.20 support level breaks, XRP could decline toward $1.93, making a $3 breakout increasingly unlikely in the near term.

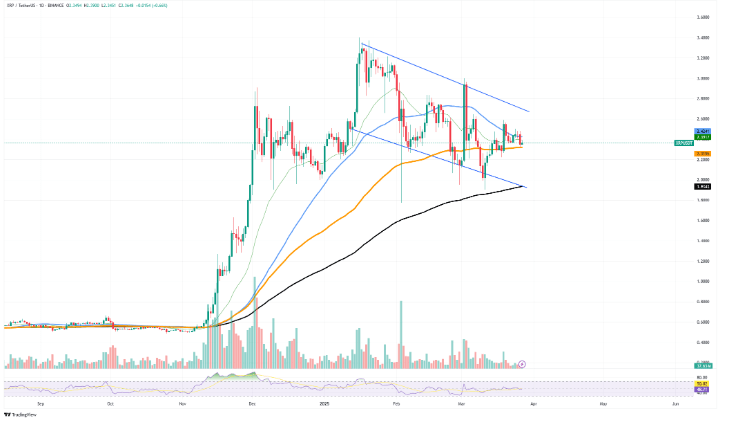

The recent price action of XRP has left investors disappointed as the token faced a significant technical rejection, making the road to a $3 breakout even more uncertain. Despite showing signs of bullish momentum in recent sessions, XRP failed to break through critical resistance levels, allowing bearish pressure to take control of the short-term market outlook.

Key Resistance Holds Strong

One of the major hurdles XRP faced was the 26-day Exponential Moving Average (EMA), which has now acted as a strong resistance level. Currently, XRP is trading at approximately $2.36 and has struggled to rise above a descending trendline that has constrained its price movement since January. The latest rejection occurred near the $2.42 level, which aligns with the 26 EMA, reinforcing bearish dominance.

Adding to the concerns, XRP remains below the 50-day EMA, which suggests that a confirmed reversal is yet to be seen. Investor confidence in a long-term uptrend is waning, and unless XRP can make a decisive breakout above these key resistance levels, the possibility of a sustained rally remains low.

Low Trading Volume Weakens Bullish Attempts

Another concerning factor is the lack of significant trading volume during the attempted breakout. Market activity has remained low, indicating a lack of conviction among buyers. This lack of support makes it harder for bulls to maintain upward momentum and gives bears an opportunity to push prices lower.

XRP is currently moving within a narrowing range, with horizontal support and descending resistance around $2.20 to $2.30. If the $2.20 support level fails to hold, the next logical target for XRP could be the 200-day moving average, positioned around $1.93. This would mark a steeper decline, further diminishing hopes for a swift recovery.

Market Sentiment Turns Bearish

The Relative Strength Index (RSI), which is currently hovering around 50, signals market indecision. However, given XRP’s failure at crucial EMAs and the declining volume, the indicator leans slightly bearish. Additionally, XRP remains trapped within a larger descending triangle, reducing the likelihood of a breakout towards $3 in the near term.

What’s Next for XRP?

For XRP bulls, the immediate priority is to defend the $2.20 level and wait for better market conditions before attempting another push higher. A combination of increased trading volume and a successful breakout above dynamic resistance levels will be essential for any meaningful recovery. Until then, XRP’s recovery path remains challenging, with bearish pressure continuing to dictate the short-term market direction.

As the worst-case technical scenario has played out, investors will need to stay cautious and monitor key support levels to assess XRP’s next potential move.