- XRP surged 3.6%, breaking past key resistance at $2.21 and forming strong support near $2.29, signaling bullish strength.

- Speculation around a spot XRP ETF and heavy trading volume suggest growing institutional interest, with a short-term price target of $2.40.

XRP’s Breakout Signals Renewed Strength

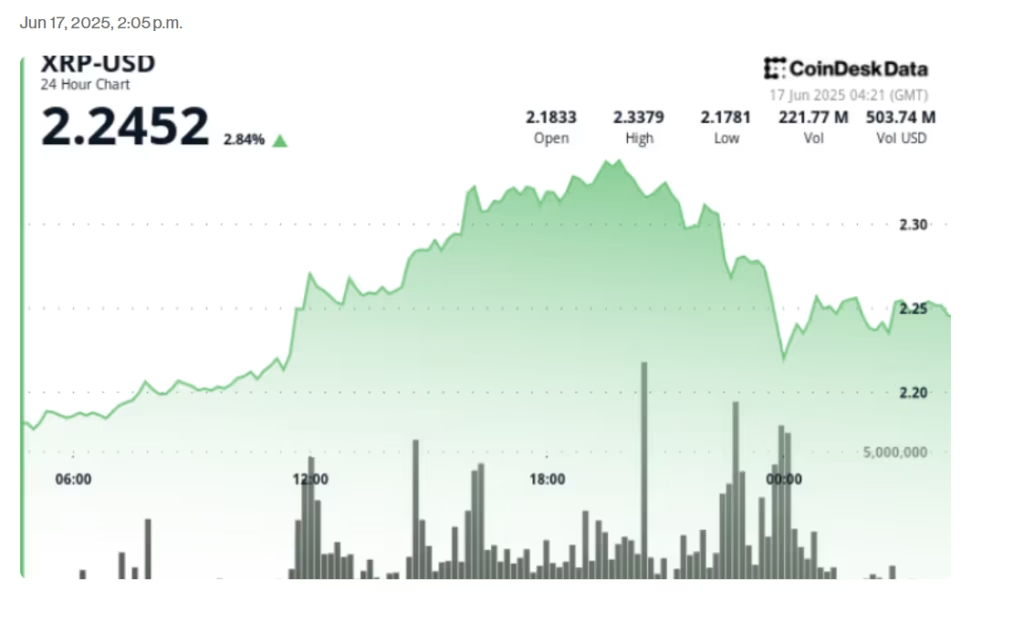

XRP has broken through key resistance levels amid volatile global markets, gaining 3.6% over the past 24 hours. The price briefly touched $2.33 before stabilizing near $2.25, signaling a bullish breakout as traders targeted $2.40. The token cleared major resistance at $2.21 and established new support at $2.29, a crucial shift that suggests bulls are firmly in control.

Institutional Interest Grows as ETF Hopes Rise

Speculation surrounding a spot XRP ETF is fueling optimism, with large block trades hinting at institutional accumulation. These moves come amid heightened global economic uncertainty, where risk assets have shown weakness. XRP, however, has shown resilience, boosted by its core use case in cross-border settlement and rising interest from large investors seeking a hedge against fiat volatility.

Technical Signals Support Further Gains

XRP traded within a wide 7.5% range from $2.177 to $2.338 during the session, driven by a surge in buying volume. Notably, over 100 million units were traded between 22:00 and 23:00 as sellers pushed the price down to $2.23. Despite this dip, buyers returned aggressively. A key burst between 01:32–01:33 saw XRP lift from $2.247 to $2.255 on 1.6 million units.

The new support zone between $2.246 and $2.29 has been tested multiple times, confirming its strength. This range has now become the battleground for bulls defending their gains and aiming to reclaim $2.30 as the next resistance.

What’s Next for XRP?

If XRP maintains support and follows the Fibonacci extension patterns identified from the day’s low, the token could target $2.40 in the short term. Volume spikes during both breakouts and retracements signal strong conviction from both buyers and sellers, though the bullish narrative currently dominates.

While broader market uncertainties persist, XRP’s performance—buoyed by ETF speculation and strong technicals—positions it as one of the more promising digital assets to watch.

ALSO READ:XRP Lawsuit Update: Ripple and SEC Extend Deadline to August 2025

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. We encourage readers to conduct further research and consult additional sources before making any decisions based on the content provided.