- XRP is drawing significant attention as speculation over a potential spot ETF grows, with strong trading volume, deep liquidity, and institutional interest positioning it as a top contender for approval ahead of the May 22, 2025 SEC deadline.

- Despite a short-term dip to $2.08, technical indicators suggest that a breakout above $2.11 could spark a fresh rally toward $2.25 or higher.

XRP is in the spotlight once again as speculation around a potential spot ETF intensifies. Despite a minor pullback of 3.22% over the past 24 hours, bringing the price to $2.08, trading volume has surged past $3 billion—underscoring sustained interest in the token.

Much of the buzz stems from Grayscale’s official filing for a spot XRP ETF, with a key SEC decision deadline set for May 22, 2025. According to crypto analytics firm Kaiko, XRP tops the list of likely candidates for ETF approval, thanks to its consistently deep liquidity, strong institutional interest, and robust trading activity.

Liquidity and Legal Wins Fuel Market Optimism

Liquidity remains a cornerstone of any ETF approval, and XRP checks all the boxes. It ranks among the top five globally in trading volume, and order books across major exchanges remain deep and active. This kind of market depth is crucial not just for ETF providers but also for investors looking to enter and exit positions with minimal slippage.

XRP’s market cap currently stands at $121.3 billion, with 58.3 billion tokens in circulation out of a maximum supply of 100 billion. Its price in Q1 ranged between $1.60 and $2.20, showcasing resilience even amid macroeconomic uncertainty.

Another key boost came on March 19 when Ripple CEO Brad Garlinghouse announced that the SEC had officially dropped its case against the company. XRP surged nearly 15% that day to $2.57 before global headwinds pulled it back.

Technical Outlook: XRP Eyes Breakout or Breakdown

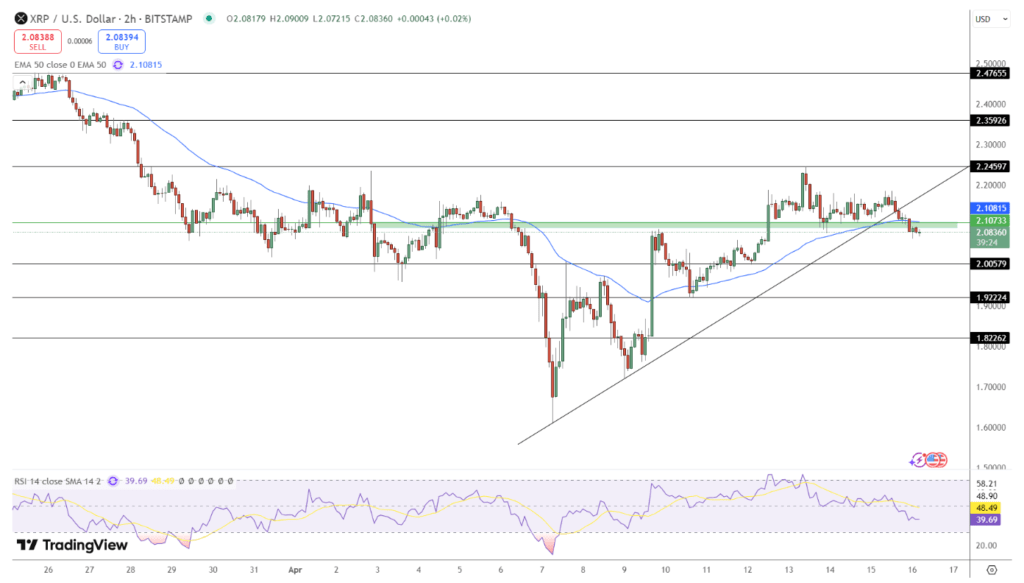

From a technical perspective, XRP appears to be in a consolidation phase. The price recently dipped below both the trendline and its 50-day EMA—currently at $2.03—indicating waning bullish momentum. The RSI is down to 39, suggesting room for either a bounce or further correction.

Short-term resistance stands at $2.11. A strong move above this level could trigger a rally toward $2.25 and potentially beyond, especially if ETF speculation heats up again. On the flip side, a break below $2.06 could send prices back to $2.00 or even $1.92.

Beginner Trade Setup

- Short Entry: Below $2.06 on confirmation

- Target Range: $2.00 – $1.92

- Stop Loss: $2.12

With the SEC deadline approaching and volume remaining strong, XRP’s next big move could come sooner than expected.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.