- XRP has seen a surge in trading volume and investor interest in early 2025, reaching peaks of $16 billion and posting strong yearly gains.

- However, on-chain activity is declining sharply, raising concerns about the disconnect between market hype and actual blockchain usage.

XRP is enjoying a powerful resurgence in early 2025, with trading volumes soaring and investor sentiment reaching new highs. However, beneath this bullish surface, key on-chain metrics reveal a sharp decline — raising questions about the sustainability of XRP’s current momentum.

MIGHT ALSO LIKE:Will Pi Network Hit $30 by 2030 or Stall Before the Finish Line?

XRP Trading Volume Surges While Price Holds Strong

XRP has shown remarkable strength, posting a 298.8% gain over the past year. In just the last 30 days, the token jumped by 26.9%, with a significant 44.89% rally recorded between January 10 and 17. XRP peaked at $3.4 on January 16, and is currently trading near $2.14, marking a 2.5% daily gain.

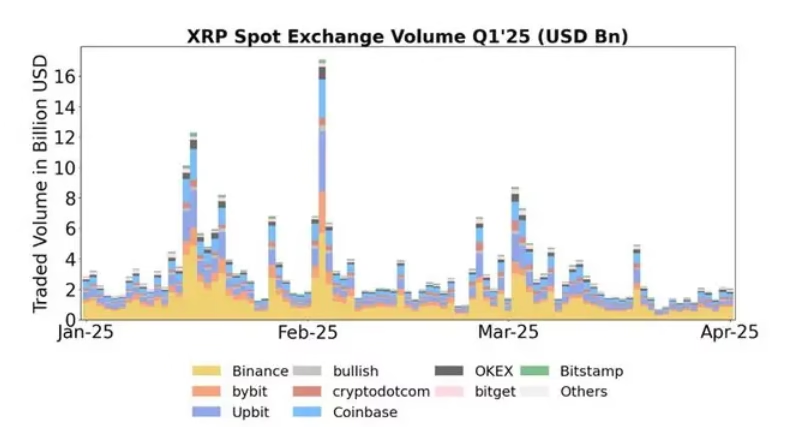

The surge in trading activity is undeniable. Daily spot trading volumes now average $3.2 billion, spiking to over $16 billion during peak periods in January and February. Investment products tied to XRP have attracted $214 million so far this year, signaling strong institutional and retail demand.

Additionally, fiat and stablecoin transactions involving XRP have grown, rising from 25% to 29% of all trades — reflecting increased interest in regulated trading pairs.

ALSO READ:Ripple Holds 4.56 Billion XRP — Is a Game-Changing Deal on the Horizon?

On-Chain Metrics Paint a Bleaker Picture

Despite the surge in trading volume, XRP’s blockchain data tells a more cautious story. The number of transactions on the XRP’s Ledger has dropped by 37.06%, and new wallet creation has fallen by more than 40.28%. Perhaps most concerning, on-chain daily volume has plummeted by over 86% in the past six months.

This divergence suggests that while speculative interest in XRP is high, actual utility and usage of the blockchain may be weakening — a potential red flag for long-term holders.

Regulatory Wins and ETF Speculation Fuel Confidence

Still, optimism remains high among investors. The U.S. Securities and Exchange Commission has officially dropped its appeal against Ripple, raising hopes for a favorable settlement. Adding to the bullish sentiment, talk of an XRP Spot ETF continues to build, with many viewing it as the next catalyst for upward price action.

While the growing gap between price momentum and blockchain fundamentals could signal near-term risk, favorable regulatory moves and mainstream interest may keep XRP in the spotlight throughout 2025.

ALSO READ:XRP Just Saved $2—But How Long Can This Support Level Last?

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.