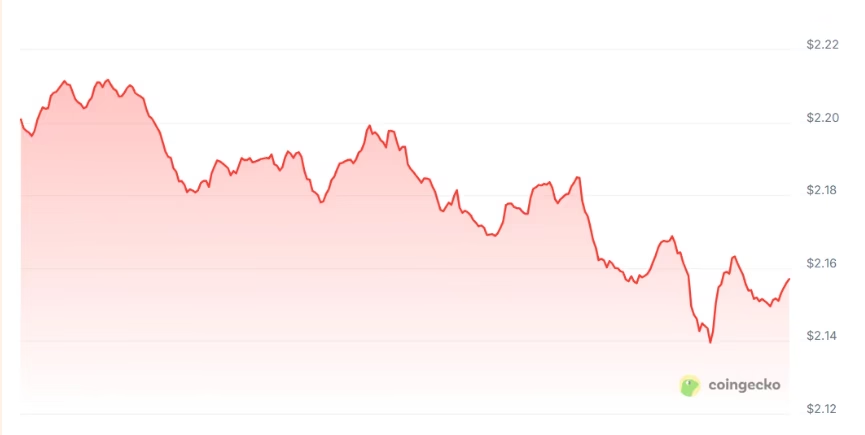

- XRP is currently trading at $2.16 and facing strong resistance at $2.22 while holding key support at $2.05, forming a bearish descending triangle pattern.

- With sentiment turning cautious and short positions dominating, a break below $2.00 could trigger further losses, while a move above $2.22 might spark a bullish reversal.

XRP is sitting at a crucial crossroads, with traders watching closely as the token tests its support near $2.05 and faces stiff resistance at $2.22. Currently priced at $2.16 USD (A$3.34), XRP has declined by 2.2% in the past 24 hours, signaling growing uncertainty in the market.

Descending Triangle Signals Trouble Ahead

On the technical side, XRP is forming a descending triangle pattern, typically seen as a bearish sign. This setup suggests sellers are becoming more aggressive, pushing the price down to retest the same support level repeatedly. If XRP breaks below $2.00, it could open the door for steeper declines toward $1.85 or even $1.70.

However, XRP’s support at $2.05 has proven resilient, being tested several times without a decisive breakdown. This stability gives bulls a sliver of hope—if it holds, a rebound could still materialize.

Bearish Sentiment Gains Strength

Market sentiment isn’t helping XRP’s case. The long/short ratio has stayed below 1 for two weeks, indicating more traders are betting against the token. Meanwhile, open interest in XRP derivatives is declining, reflecting caution among traders.

Yet, despite the reduced number of positions, short positions dominate, meaning that those still active in the market are largely expecting the price to fall. The Relative Strength Index (RSI) is at 47, a neutral reading but with a downward trend—again pointing to a slight bearish bias.

What Comes Next: Two Likely Scenarios

With XRP consolidating between major levels, the market could go either way in the short term:

- Bullish Scenario: A breakout above $2.22, especially on strong volume, could signal a trend reversal and invalidate the bearish triangle. This might push XRP toward higher resistance levels and boost investor confidence.

- Bearish Scenario: A break below $2.00 would likely confirm the bearish setup, triggering a sharper drop to $1.85 or $1.70, as technical selling pressure builds.

XRP is clearly at a tipping point. With market sentiment leaning bearish and price action confined within a narrowing range, the next few days will be critical. A decisive move—either way—could define XRP’s direction for weeks to come.

MIGHT ALSO LIKE:Ripple (XRP) and Chainlink’s (LINK) Secret Game Plan to Influence U.S. Crypto Regulations

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.