- XRP is trading at $2.29 with low volatility, which analysts view as a signal for a potential breakout toward $3.87 and beyond.

- Optimism is further supported by long-term price forecasts and the SEC’s ongoing review of an XRP ETF, which could boost institutional interest.

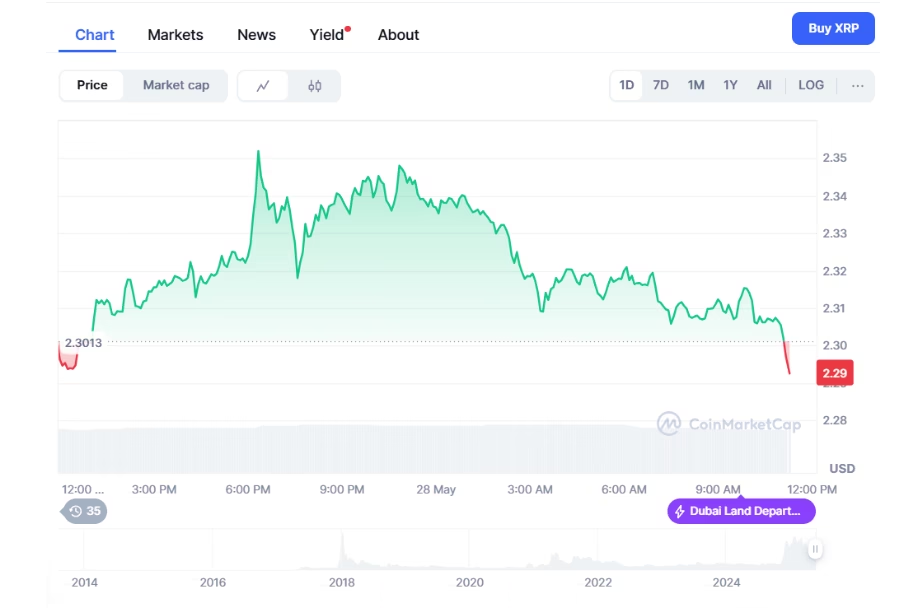

XRP is currently trading at $2.29, recording a modest 0.47% daily decline and a weekly dip of 3.72%. But despite the sluggish performance, analysts believe the subdued price movement may be the calm before a bullish storm. With low volatility and decreasing trading volume—down 1.01% to $2.1 billion—XRP appears to be preparing for a potential breakout.

ALSO READ:Stellar Flips Shiba Inu in Market Cap — Will This Change Last?

Bullish Reversal Pattern Sparks Optimism

Technical analysts have noted XRP’s price respecting a prolonged descending channel, often seen as a precursor to bullish reversals. The key support zone is identified at $1.8502, a confluence of trendlines and Fibonacci retracement levels. According to crypto analyst VipRoseTr, this area could serve as a launchpad if XRP breaks above resistance near $2.30.

Should the breakout materialize, projected price targets stand at $2.95, $3.39, and $3.87—implying gains of over 100% from the support zone. The lack of strong selling pressure, coupled with recent indecisive candlestick formations, supports this bullish view.

Long-Term Forecasts Remain Strong

Beyond the near-term setup, longer-range predictions for XRP paint a promising picture. DigitalCoinPrice anticipates that the token could reach between $4.82 and $5.01 by the end of 2025. This would represent a new all-time high, exceeding the previous record of $3.84. XRP’s earlier spike to $3.39 this year further bolsters confidence in its recovery potential.

Analysts argue that once broader market sentiment improves and legal uncertainties surrounding XRP are resolved, the token could see accelerated growth. Its position among large-cap cryptocurrencies and increasing institutional interest continue to provide strong support for a sustained rally.

XRP ETF Review Hints at Regulatory Progress

Adding to the bullish narrative is the SEC’s ongoing review of WisdomTree’s application for a spot XRP ETF. The public comment period has ended, and the regulatory body now enters a more intensive examination phase that could last up to 240 days.

While an immediate approval is unlikely, the review process itself signals cautious optimism. Emily Clarke, Head of Research at Digital Asset Management, noted that “the new SEC leadership appears more open to crypto,” potentially paving the way for future ETF approvals.

If approved, the ETF could provide a major catalyst for XRP, attracting institutional capital and reinforcing its legitimacy in the eyes of traditional investors.

In summary, XRP’s low volatility phase might be setting the stage for a significant breakout. With bullish technical patterns, favorable long-term forecasts, and positive regulatory developments, XRP could soon reclaim—and surpass—its all-time highs.

MIGHT ALSO LIKE:How TRON’s Correlation with Bitcoin Could Boost Its Price in 2025

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.