- Sui (SUI) is approaching a key resistance at $3.65 after a 10% price jump, driven by rising Open Interest and bullish trader sentiment.

- A breakout could lead to a 15% rally, supported by Adidas’s Web3 partnership and strong technical indicators.

Sui (SUI) is gaining strong momentum this week, with bulls pushing the price nearly 10% higher on Thursday alone. The token now sits just below a key resistance level at $3.65, a break above which could ignite a 15% rally toward its previous high of $4.25.

ALSO READ:Will Pi Network’s 231M Token Unlock Lead to a Price Crash?

Bullish On-Chain Signals Fuel the Rally

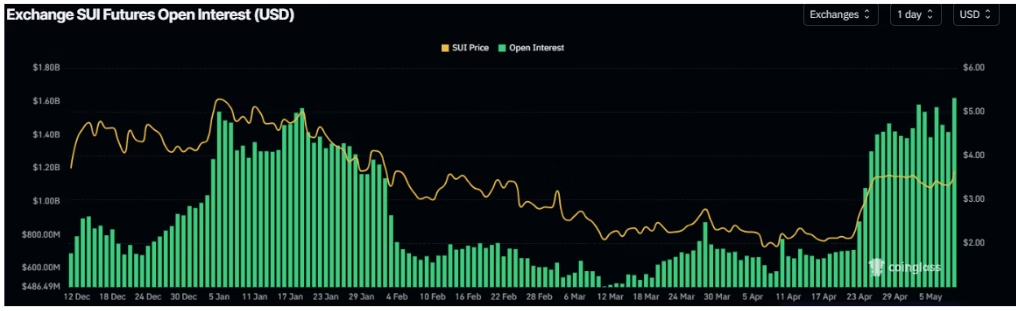

The rally is backed by rising trader optimism and on-chain activity. According to Coinglass, Sui’s Open Interest (OI) surged from $1.39 billion on Monday to a record $1.62 billion by Thursday. This jump indicates new capital entering the market and growing confidence in a sustained uptrend.

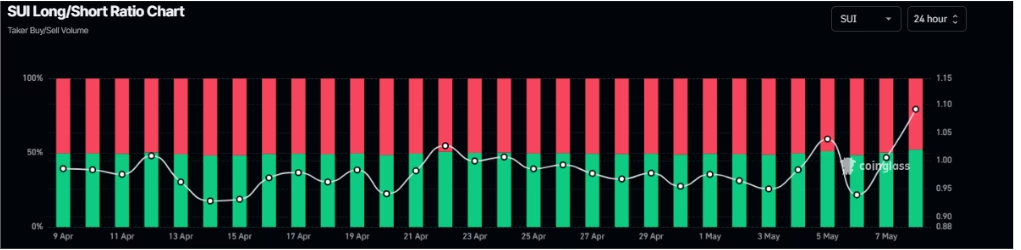

Additionally, the SUI long-to-short ratio has climbed to 1.09, its highest in over a month. A ratio above one signals that more traders are betting on price increases than declines—further evidence of bullish sentiment.

Adidas Partnership Boosts Ecosystem Confidence

Sui’s growing appeal isn’t just technical. The network recently received a major endorsement from Adidas, which announced a collaboration with XOCIETY, a flagship Web3 game hosted on the Sui blockchain. This partnership introduces exclusive Adidas digital apparel NFTs into the game and expands Sui’s real-world use case in digital fashion and gaming—boosting both adoption and token utility.

adidas x @xocietyofficial is more than a collab — it’s a statement.

Web3 gaming isn’t coming. It’s here.

And it’s dripping in culture, identity, and onchain permanence.

Built on Sui. Built for the future. 🛠️👟 https://t.co/RxGgBuHnVI

— Sui (@SuiNetwork) May 6, 2025

What’s Next for SUI Price?

With price action pushing closer to $3.65, SUI needs a daily close above this resistance to confirm the bullish breakout. A successful breach could open the path to a 15% rally, targeting the January high of $4.25.

Technical indicators reinforce this outlook. The Relative Strength Index (RSI) has climbed above 70, pointing to strong upward momentum. Though this places SUI in overbought territory, a continued rally remains likely if bullish pressure persists. Meanwhile, the MACD indicator is on the verge of confirming a bullish crossover, another potential buy signal.

Risk of Pullback Remains

Despite the optimism, traders should remain cautious. Overbought conditions could lead to a temporary correction. If SUI fails to hold its current levels, a decline back to Tuesday’s low of $3.12 is possible.

Sui appears poised for a breakout, fueled by surging Open Interest, rising bullish bets, and strong ecosystem developments. A move above $3.65 could unlock new highs—while a pullback remains a risk if momentum falters.

ALSO READ:Glassnode Report Reveals XRP as the Only Top Crypto With a Positive Cost Basis

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.