- XRP is consolidating above $3, showing resilience despite low trading volume.

- Key resistance levels at $3.2, $3.6, and $4 will influence its next move.

XRP Reclaims Key $3 Level

Ripple’s XRP continues to trade above the $3 mark, showing resilience as buyers fend off attempts by sellers to push it lower. Over the past week, the token successfully consolidated gains above this crucial support level, signaling a potential foundation for the next upward move. However, analysts warn that the rally could be fragile due to low trading volumes accompanying the price rise.

Consolidation Signals a Pause Before Potential Breakout

Since July, XRP has been hovering around $3, suggesting a period of extended consolidation. Technical analysis points to $3.2 as the immediate resistance, followed by stronger levels at $3.6 and $4. Breaking these levels could give buyers a clear advantage and possibly trigger a more decisive rally. For now, the token remains in a cautious equilibrium as investors await clearer market direction.

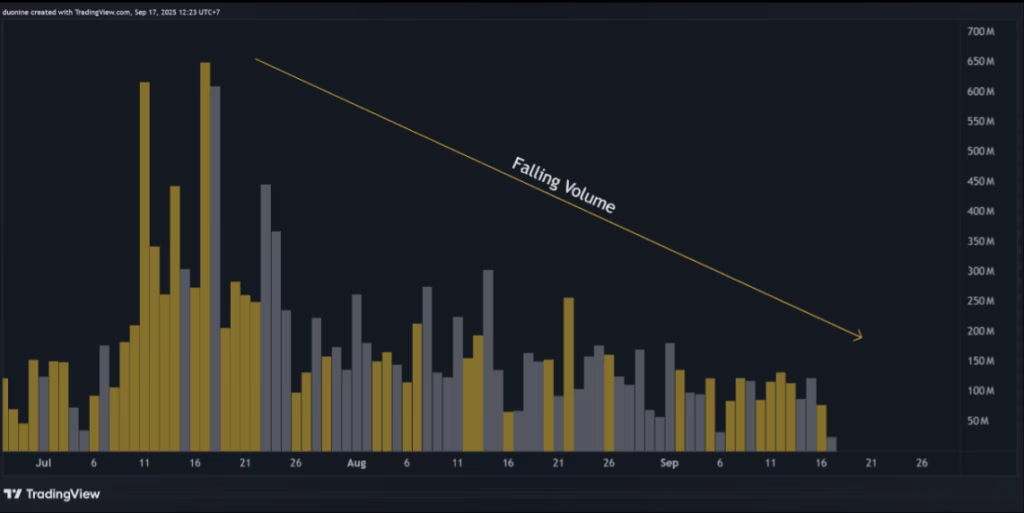

Falling Volume Reflects Market Caution

Despite reclaiming $3, XRP’s trading volume continues to decline, highlighting a lack of strong market enthusiasm. This subdued activity explains why the token’s upward movement has been relatively flat in recent months. Without a surge in buying interest, any price advances may remain limited, emphasizing the importance of volume in confirming potential breakouts.

What’s Next for XRP?

Traders will be closely watching XRP’s ability to surpass $3.2, which could pave the way for testing higher resistance levels at $3.6 and $4. Conversely, failure to maintain the $3 support might open the door for sellers to push the token lower. Overall, the current consolidation phase reflects a market in wait-and-see mode, with investors evaluating both technical signals and broader market sentiment.

ALSO READ:Ripple vs. SEC: How XRP Turned a Legal Nightmare Into a Strategic Advantage

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.