- Binance’s addition of the Ripple-USDC pair failed to spark the anticipated surge in XRP prices, shedding light on the persistent challenges Ripple faces, including legal issues and regulatory uncertainties.

- Beyond exchange listings, stablecoin pairings, regulatory concerns, and overall market sentiment collectively shape cryptocurrency prices. Investors must navigate this intricate landscape, considering both exchange-related events and broader industry trends.

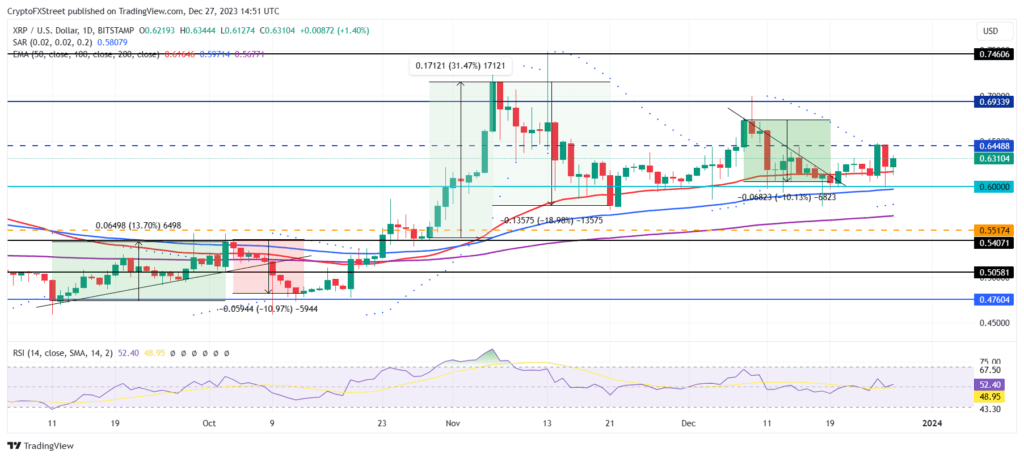

Cryptocurrency enthusiasts and investors eagerly anticipate the impact of major exchange listings on digital asset prices. Binance, one of the world’s leading cryptocurrency exchanges, recently added a Ripple (XRP) and USDC trading pair to its platform. However, the expected surge in XRP’s value following this listing did not materialize as many had hoped.

Ripple’s Ongoing Challenges

Despite being a prominent cryptocurrency, Ripple (XRP) has faced a series of challenges, including legal battles with regulatory authorities. These uncertainties have cast a shadow over the coin, affecting its market performance and hindering potential bullish movements triggered by positive developments such as exchange listings.

Analyzing Market Sentiment

Market sentiment plays a crucial role in the world of cryptocurrencies. Traders often react swiftly to news and announcements, and the Binance listing of the XRP-USDC pair was no exception. While some expected a notable uptick in XRP’s value, others remained cautious, considering the broader challenges facing Ripple.

The Impact of Stablecoin Pairings

Binance’s decision to pair XRP with USDC, a stablecoin pegged to the US dollar, raised questions about the significance of stablecoin pairings in influencing cryptocurrency prices. While stablecoins are designed to maintain a stable value, their pairing with other cryptocurrencies can sometimes dampen volatility and limit price movements.

Navigating Regulatory Hurdles

Ripple’s legal battles with regulatory authorities, including the U.S. Securities and Exchange Commission (SEC), have been a significant factor influencing its market performance. Investors keenly follow regulatory developments, and any progress or setbacks in Ripple’s legal challenges can have a profound impact on its price trajectory.

The Role of Binance in the Crypto Ecosystem

As one of the largest cryptocurrency exchanges globally, Binance has the power to influence market trends. However, it’s essential to recognize that while exchange listings can generate excitement, they may not always lead to sustained price rallies. The broader market conditions, investor sentiment, and regulatory landscape also play pivotal roles in determining a cryptocurrency’s trajectory.

Conclusion:

The recent Binance listing of the Ripple-USDC trading pair brought attention to the challenges facing Ripple amidst its legal battles and regulatory uncertainties. Despite the anticipation of a price surge, XRP’s market response was muted. This incident emphasizes the intricate interplay of various factors, including regulatory developments, stablecoin pairings, and overall market sentiment, in influencing cryptocurrency prices. Investors and enthusiasts alike must navigate these complexities while keeping a close eye on both exchange-related events and broader industry trends to make informed decisions in the ever-evolving crypto landscape.