- Bitcoin faces a pivotal moment as its price battles around the $42K level, with the recent rejection at $48K raising questions about the sustainability of the bullish trend.

- Technical patterns, such as a corrective formation on the daily chart and the potential impact of extremely high funding rates, suggest a challenging road ahead, leaving investors uncertain about whether a renewed uptrend or further decline is on the horizon.

Bitcoin enthusiasts have been on a rollercoaster ride as the cryptocurrency’s price recently faced a setback after being rejected at the crucial $48K level. With the market dynamics in flux, investors are grappling with the question of whether the bullish trend has concluded or if there’s still potential for a new all-time high.

The Daily Chart Dilemma

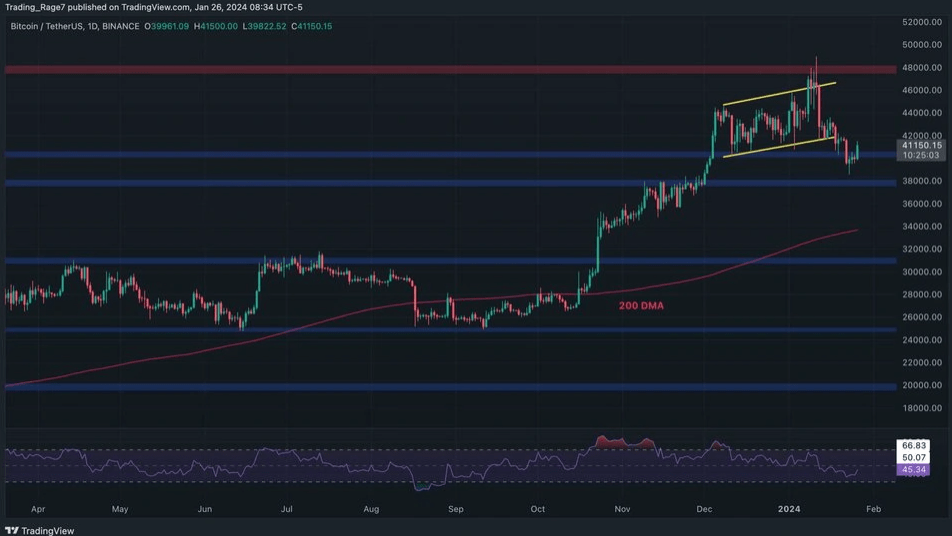

A closer look at the daily chart reveals a concerning pattern—a formation and subsequent break below an ascending channel beneath the $48K resistance level. This corrective or bearish reversal pattern becomes pivotal, especially if the price fails to re-enter the channel. Currently, the $40K support zone is holding ground, but the Relative Strength Index below 50% indicates a looming risk of further decline.

The $42K Showdown

At the time of this writing, Bitcoin has surged above $41K, gathering momentum to challenge the $42K level. The four-hour timeframe provides additional insights into short-term price action. While the cryptocurrency has recovered above $40K, the upcoming battle lies in retesting the broken trendline—the lower boundary of the shattered ascending channel. A failure to break above could signal a potential turning point, potentially driving the price lower toward the $38K support level in the weeks ahead.

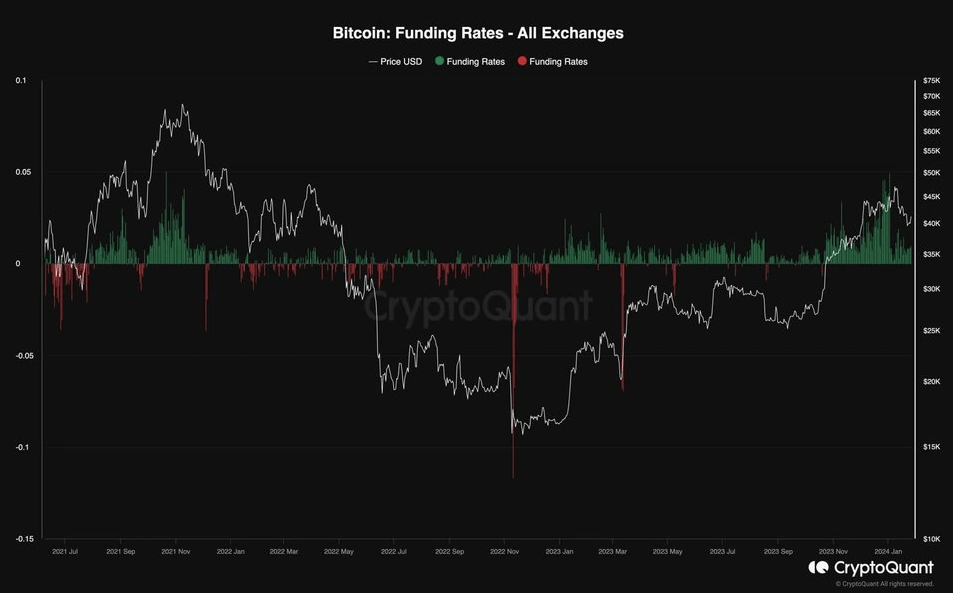

During the final weeks of the recent uptrend, optimism ran high among market participants anticipating a new all-time high for BTC. However, the euphoria might have played a role in the recent dip. A critical metric in evaluating market sentiment is the Bitcoin funding rates, indicating whether buyers or sellers are executing orders more aggressively.

The chart illustrates that funding rates reached extremely high values during the recent peak, akin to those seen during the $69K all-time high range. This raised red flags, hinting at an impending deep correction or even a bearish reversal.

In the volatile realm of cryptocurrency, the battle at $42K will unfold as a defining moment. Will the bulls maintain control and pave the way for a renewed uptrend, or is Bitcoin poised for a stall, succumbing to the pressures of recent market sentiment and technical patterns? As the crypto community holds its breath, the $42K level remains a critical juncture for Bitcoin’s next move.