- Bitcoin price is holding near $111,575 as buyers step in, aiming for a breakout above $112K.

- Market attention focuses on U.S. jobs data and potential Fed rate cuts that could influence BTC’s next move.

Bitcoin is currently trading at $111,575 as buyers continue to support the market, aiming for a close above $112K. BTC briefly rallied to $112,600 on Wednesday before sellers took control, dragging the price down to $109,329 during the Asian session. Despite the setback, both retail and institutional investors have been active in spot markets, signaling confidence in Bitcoin’s long-term outlook.

ALSO READ:Bitcoin Bear Market Looms: Could BTC Bottom at $50K by 2026?

The BTC/USDT heatmap highlights that the price is tightly constrained between $109,000 and $111,200. Short-term traders are locking in quick profits, keeping Bitcoin in a narrow range. However, many buyers are betting on a breakout if bullish conditions strengthen.

Labor Market Data at the Center of Attention

Traditional markets are on “pins and needles” as investors await Friday’s key jobs data. Earlier in the week, ADP’s private hiring report disappointed, showing only 54,000 jobs added in August versus the 75,000 expected. This raised concerns about the health of the labor market.

The official U.S. jobs report will be more telling. Economists are hopeful for 80,000 new jobs, but a significantly lower figure could point to deeper labor market weakness. Currently, unemployment stands at 7.24 million, exceeding the 7.18 million people employed—an unsettling sign for policymakers.

Fed Rate Cuts Could Spark a BTC Rally

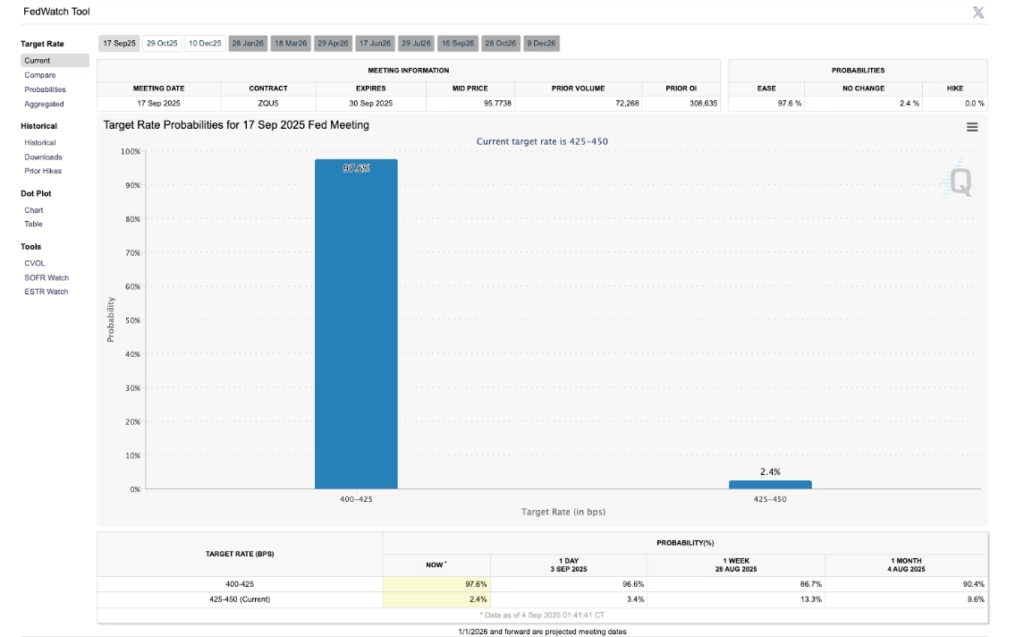

For Bitcoin traders, a weaker labor market might actually be good news. A slowdown would give the Federal Reserve more reason to cut interest rates at its September meeting. The CME Group’s FedWatch tool shows a 97.6% probability of a 25 basis point cut, which could encourage risk-taking and support a BTC rebound.

Market watchers believe a rate cut would provide the boost needed for Bitcoin to reclaim and hold the $112,000 level. Until then, uncertainty in macroeconomic data continues to influence price action.

Bitcoin’s future direction hinges on both trader appetite and the U.S. labor market report. While buyers remain active, a decisive close above $112,000 is still the hurdle bulls must clear. With a likely Fed rate cut on the horizon, Bitcoin traders may soon get the catalyst they are waiting for.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.