- Samson Mow makes a bold prediction of Bitcoin reaching $1 million soon, attributing it to factors like halving events, ETFs, and increasing institutional involvement.

- Mow emphasizes the perfect setup of demand outstripping supply, alongside the Veblen Effect, as key drivers of Bitcoin’s anticipated surge.

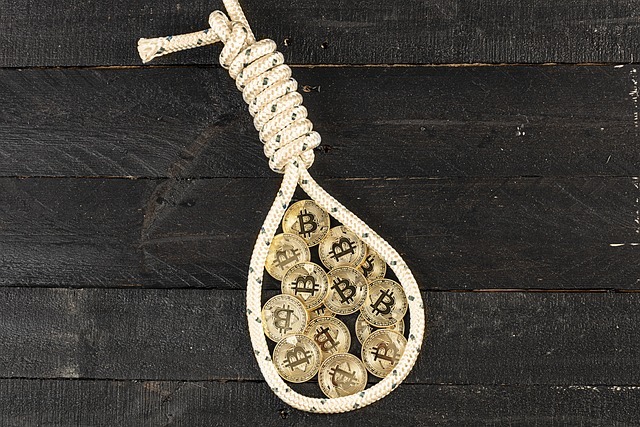

Bitcoin to Hit $1,000,000 “Very Soon,” Asserts Samson Mow – Unraveling the Impacts of Halving, ETFs, and Institutional Participation

Bitcoin, the pioneering cryptocurrency, has been on a remarkable upward trajectory, with experts and enthusiasts alike speculating on its future trajectory. Samson Mow, CEO of JAN3, a Bitcoin-centric tech firm, recently made headlines by forecasting an unprecedented milestone for Bitcoin – a staggering $1 million per coin.

Mow’s bold prediction comes amidst a backdrop of significant developments in the cryptocurrency space, including halving events, the emergence of Bitcoin exchange-traded funds (ETFs), and increased institutional involvement.

Mow’s prognostication, shared during a discussion on the What Bitcoin Did podcast, paints a picture of immense potential growth for Bitcoin, estimating a potential surge of approximately 1,264% from current levels. He emphasized the crucial role played by supply-demand dynamics, upcoming halving events, and the rising popularity of Bitcoin ETFs in driving this anticipated rally.

“The whole setup we have right now is perfect for a run-up. You have demand far outstripping supply. And supply is about to be cut. The exchange-traded funds (ETFs) alone are pulling in about 22,000 BTC… So demand is like 10x. Now it’s going to 20x, so the price should react accordingly,” Mow explained.

Drawing parallels with the Veblen Effect, Mow highlighted how Bitcoin’s increasing value could further fuel its demand. He suggested that as Bitcoin approaches parity with the gold market cap, its attractiveness as a store of value would intensify, potentially leading to a tipping point where Bitcoin surpasses gold as the preferred asset.

The transition from gold to Bitcoin as the dominant store of value marks a significant paradigm shift in the financial landscape. Mow envisions Bitcoin’s ascent as not just a speculative phenomenon but a fundamental reevaluation of traditional assets’ worth.

Amidst these discussions, the emergence of Bitcoin ETFs has been a game-changer, attracting significant capital inflows and signaling a broader acceptance of cryptocurrencies among institutional investors. Analysts project substantial growth in Bitcoin ETFs, with potential inflows totaling billions of dollars in the coming years. This influx of institutional capital could serve as a catalyst for Bitcoin’s exponential price appreciation, potentially quadrupling its value to $280,000, as per JMP Securities’ research report.

As Bitcoin continues to break barriers and redefine the financial landscape, Samson Mow’s bullish forecast serves as a testament to the cryptocurrency’s resilience and potential. While uncertainties abound, the convergence of favorable market conditions, institutional adoption, and technological advancements sets the stage for Bitcoin’s ascent to unprecedented heights.