- Cardano price is facing resistance near $0.70, with a potential pullback to $0.55 if key support levels break.

- Despite the bearish trend, rising long positions signal growing confidence, and a breakout above $0.76 could push ADA towards $1.

Cardano (ADA) has been facing critical resistance near the $0.70 mark, and despite attempts to push higher, the price is showing signs of vulnerability. With a bearish trend dominating the market, traders are left wondering whether ADA will be able to sustain its support at $0.60 or if a pullback to $0.55 is imminent.

Price Action at a Crossroads: Will Bulls Push Cardano (ADA) to $1?

Cardano’s price recently experienced a 3.34% decline, dropping from $0.69 to $0.6764 over the weekend. Despite this dip, ADA has maintained its position above crucial dynamic support, a key level that could act as a final defense before a potential breakdown. While the ADA market is currently navigating through turbulent waters, the surge in long positions within the derivatives market reflects growing confidence from traders.

However, the question remains: will this confidence lead to a bullish push towards $1, or will ADA retest $0.55?

MACD Warning Signals a Potential Breakdown

One of the critical indicators signaling a bearish outlook for ADA is the behavior of the Moving Average Convergence Divergence (MACD) line. The MACD has recently merged with the signal line, hinting at a possible bearish crossover. If this occurs, the selling pressure could intensify, increasing the chances of a price drop below the $0.60 psychological support. A breakdown could eventually send ADA’s price to retest its previous low of $0.55, which remains a significant support level for the token.

The Role of AI Testnet and Market Sentiment

While the announcement of an AI-powered testnet for Cardano’s Leios protocol initially sparked some excitement, it wasn’t enough to sustain a bullish rally. The Leios protocol promises to boost Cardano’s transaction throughput and scalability, preparing the network for post-quantum cryptography. Though this innovation strengthens Cardano’s long-term outlook, the market’s immediate reaction has been subdued.

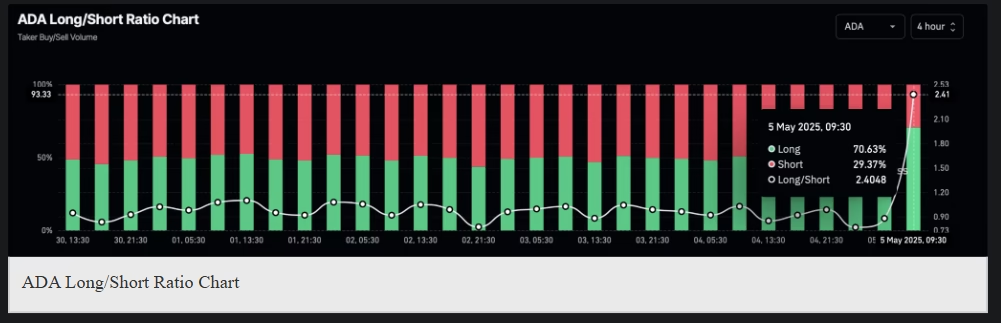

Despite the weekend’s pullback, ADA traders have shown increased optimism, with the ADA long-to-short position ratio climbing to 70%. This rise in long positions suggests a solid bullish sentiment, though a potential reversal remains dependent on breaking key resistance levels. If ADA manages to break through the $0.76 resistance zone, it could set the stage for a surge towards $1. Traders are closely monitoring the $0.7673 level, as a successful breakout could propel Cardano towards its next major milestone.

As the market remains volatile, Cardano’s price action will depend largely on its ability to hold support at key levels and overcome significant resistance. For now, ADA’s future remains uncertain, and traders should brace for possible fluctuations as they await clearer direction.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.