- Ethereum’s price continues to fall due to economic pressures, including rising tariffs and a Federal Reserve official’s warning about maintaining high interest rates to curb inflation.

- While the short-term outlook is bearish, a potential recession and rate cuts by the Fed could provide some relief for Ethereum in the future.

Ethereum’s price has faced a significant downturn this month, dropping as low as $1,800. The latest warning from a key Federal Reserve official hints at even more challenges ahead for the cryptocurrency. With global tariffs and economic shifts threatening further volatility, Ethereum’s prospects appear uncertain.

Fed’s Stance on Interest Rates Signals Trouble for Ethereum

The recent warning issued by Adriana Kugler, a Federal Reserve governor, sheds light on the potential path for interest rates in the U.S. She expressed support for maintaining current rates to combat rising inflation, which could negatively impact the economy. If the Fed continues to hold rates high, it would likely put additional pressure on assets like Ethereum, which have historically thrived during periods of easy money and low-interest rates.

Ethereum and other altcoins tend to benefit in times of economic loosening, but with the possibility of tighter monetary policy, the outlook for Ethereum appears bearish. The continued increase in tariffs on imported goods, particularly from key trading partners like China and the EU, may trigger inflationary pressures that could weigh heavily on the broader market.

The Tariff Impact: Inflation and Economic Disruptions

The ongoing tariff increases are likely to push inflation higher, as importers pass these additional costs on to consumers. For example, industries reliant on imported goods—such as manufacturing—could be significantly impacted. Companies like Boeing, which depends on foreign-sourced materials, may find themselves facing higher production costs, further compounding inflationary pressures. This could lead to broader economic slowdowns, as consumers feel the pinch from rising prices.

While a recession is far from desirable, some experts believe that the U.S. might experience one in the wake of these tariff hikes. The silver lining, however, is that a recession could prompt the Federal Reserve to reverse its course and lower interest rates. This scenario could prove beneficial for Ethereum and other cryptocurrencies, as lower interest rates often drive investors toward riskier assets in search of better returns.

Ethereum’s Price: Bearish Trends and Key Levels to Watch

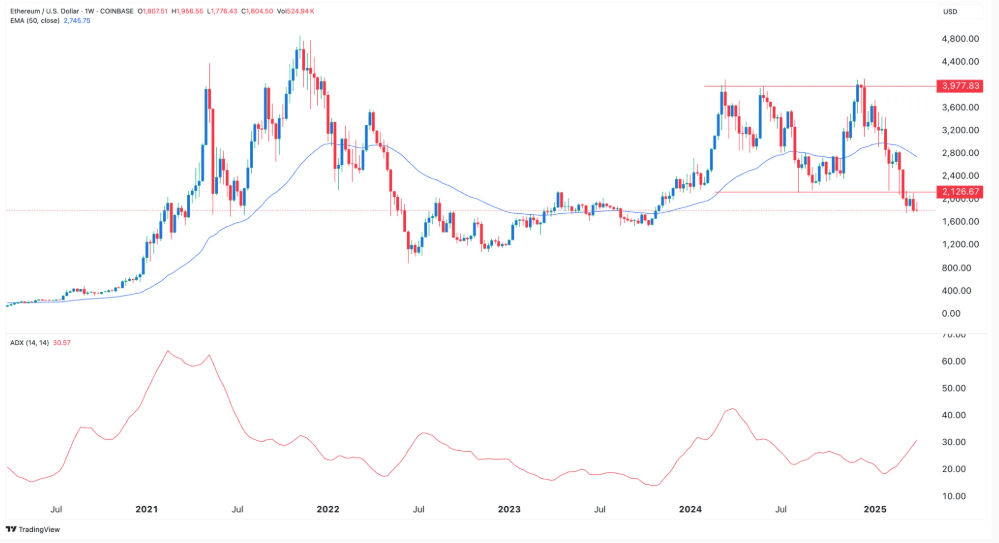

Ethereum’s price chart paints a worrying picture. The cryptocurrency has already breached key support levels, with the latest drop below $2,125 marking the lowest point since August 5. Notably, this level had been a significant support area, serving as the neckline of a triple-top pattern that once peaked at $4,000.

As Ethereum continues to trade below the 50-week moving average, technical indicators suggest that the bearish trend is gaining momentum. The Average Directional Index (ADX) has climbed to 30, signaling that the selling pressure may only intensify. With key support now at $1,500, Ethereum’s price could continue its descent if market conditions don’t improve.

In conclusion, the combination of rising tariffs, inflationary pressures, and a potentially hawkish Fed policy could weigh heavily on Ethereum’s price in the short term. However, if the U.S. does enter a recession and the Fed cuts rates, Ethereum and other altcoins may find some relief, as riskier assets often perform better in such an environment. For now, though, investors will need to keep a close eye on the evolving economic situation.