- Ethereum transaction fees have dropped to historic lows due to innovations like Layer 2 solutions and EIP-4844, boosting accessibility but significantly reducing validator revenue.

- Despite steady network activity, ETH’s price has underperformed, raising concerns about long-term economic sustainability and the disconnect between utility and token value.

Ethereum has entered a new chapter, marked by historic lows in transaction fees. While that might sound like great news for users, the story underneath reveals a complex and evolving landscape with real consequences for validators and long-term investors.

Layer 2 Innovations Are Changing the Game

A key reason behind the drop in fees is the rise of Layer 2 solutions like Base, which are designed to scale Ethereum by handling transactions off the main blockchain. Coupled with the implementation of EIP-4844—also known as Proto-Danksharding—these changes have introduced “blob transactions” that dramatically reduce costs for storing data. As a result, Ethereum’s average weekly fee revenue has fallen sharply, from around $30 million in March 2024 to just under $500,000 in early April 2025.

The transaction count, however, has remained surprisingly stable. Ethereum is still seeing around 1.2 million daily transactions, suggesting the network is as busy as ever—but now much cheaper to use.

Lower Fees Come With Hidden Risks

While users and developers benefit from lower transaction costs, validators—the people who help secure the network—are taking a financial hit. These validators rely heavily on transaction fees for income. With revenues down 98% from their peak, there’s growing concern about the long-term sustainability of the network’s economic model.

If Ethereum can no longer reward validators effectively, it may have to increase ETH issuance to maintain security. That could bring inflationary pressure, which would weigh down the price even further.

ETH Price: Struggling Despite Growing Utility

Despite Ethereum’s growing role in powering decentralized finance (DeFi), stablecoins, and real-world asset (RWA) protocols, the price of ETH has fallen dramatically. In Q1 of 2025 alone, Ethereum dropped by 49%, severely underperforming Bitcoin. This disconnect between utility and price challenges the belief that network use directly drives token value.

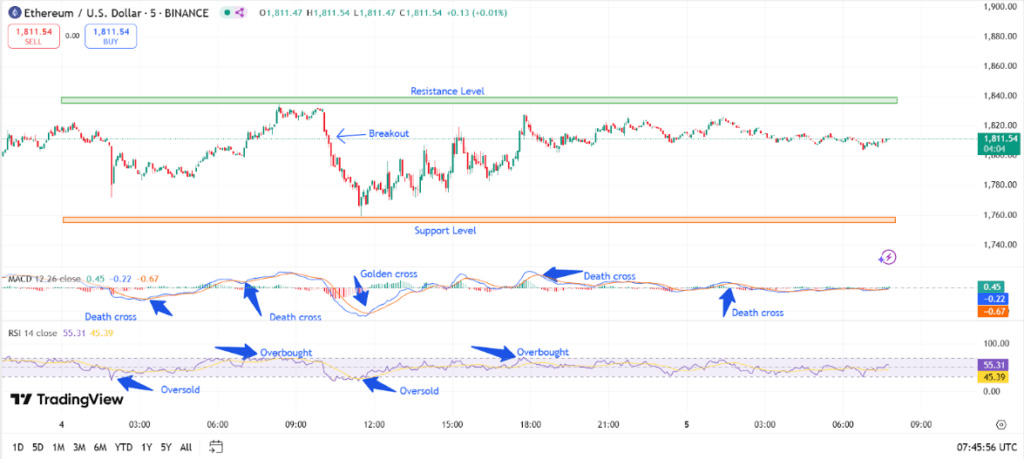

As of April 5, ETH is trading in the $1,772 to $1,822 range, struggling to break above resistance levels despite some bullish interest from whale investors. Technical indicators like the Relative Strength Index (RSI) suggest weak momentum, making the next move unpredictable.

Ethereum’s long-term price outlook remains mixed. Analysts predict ETH could end 2025 anywhere from $1,905 to $6,474. By 2030, more optimistic forecasts place the coin above $10,000, hinging on its dominance in DeFi and real-world asset integration.

For now, Ethereum’s lower fees represent both a breakthrough in accessibility and a challenge to its economic foundation. The network is evolving—but whether that evolution leads to growth or growing pains remains to be seen.