Ethereum has stunned the crypto market with an impressive price surge of about 30% in the last 24 hours, trading at $2,449.52 at the time of writing. The market capitalization now boasts a live market cap of $295.73 billion and a 24-hour trading volume of $43.88 billion, according to the latest data.

Recently, the coin has been stagnant, but at the moment, the coin is one of the best-performing top coins.

Related: Ethereum Could Be 100x Faster: Buterin Proposes Bold RISC-V Upgrade

Ethereum Foundation’s Strategic Investment

One of the significant factors driving this rally is the Ethereum Foundation’s recent decision to inject $32.65 million into Layer 2 technology, zero-knowledge proofs (ZKPs), and educational initiatives.

This substantial funding allocation underscores Ethereum’s commitment to enhancing scalability, security, and community growth.

The Foundation’s focus on Layer 2 scaling and educational programs reflects a long-term vision for expanding Ethereum’s ecosystem. Community initiatives, such as the Arabic Blockchain Developer Bootcamp and regional events like ETHPrague and ETHiopia, aim to foster global developer participation.

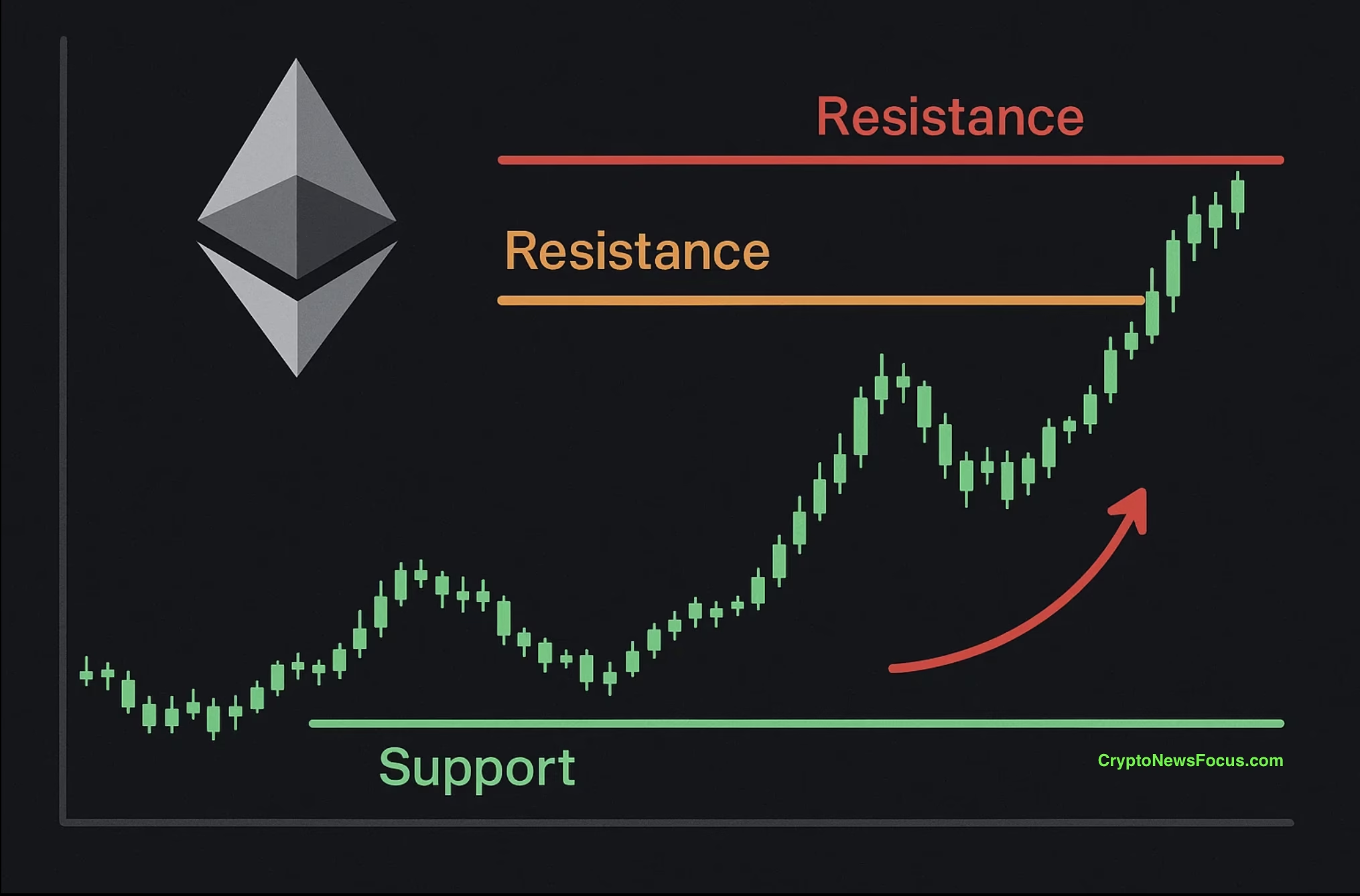

Also Read: Will Ethereum Overcome Resistance and Break $2.5K in May?

The Layer 2 Controversy: A Double-Edged Sword

However, the rise of Layer 2 solutions like Base has sparked debate within the Ethereum community. Despite leveraging Ethereum’s security, some Layer 2 platforms retain most transaction fees, contributing minimally to the Ethereum mainnet.

Base, for instance, has reportedly generated $98 million in user-transaction fees but only paid around $4.9 million to Ethereum, raising questions about fairness. Proponents argue that Layer 2s offer faster and cheaper transactions, driving Ethereum adoption.

Still, critics see them as extractive, capitalizing on Ethereum’s security without sufficient compensation.

The Road Ahead: Scaling and Fair Revenue DistributionEthereum’s recent Pectra upgrade, which increases blob capacity from three to six per block, is expected to boost Layer 2 fee contributions to the mainnet. Further proposals, such as EIP-7762, aim to adjust fee structures and enhance Ethereum’s revenue from Layer 2 activities.

While the debate over Layer 2 fees continues, Ethereum remains a powerhouse in the blockchain space. Its strategic investments, coupled with technical upgrades, solidify its position as a leader in decentralized finance and blockchain innovation.

The recent price surge is a clear sign that Ethereum is not holding back, pushing forward with innovation, scalability, and community engagement. Investors will be watching closely to see if this momentum continues.