- The expiration of over $14 billion in Bitcoin and Ethereum options today is expected to cause significant market volatility, with Bitcoin’s max pain point at $85,000 and Ethereum’s at $2,400.

- market concerns, including potential US tariffs, add complexity to the situation, making it a challenging environment for investors in the short term.

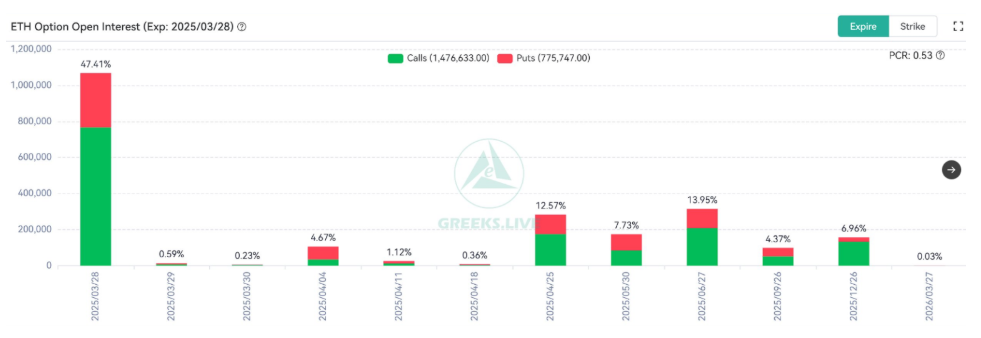

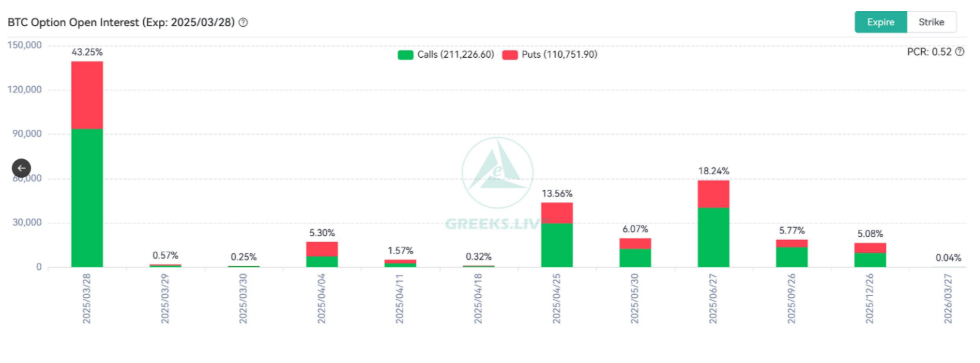

Today marks a pivotal moment in the cryptocurrency market as more than $14 billion worth of Bitcoin and Ethereum options are set to expire. Such large-scale expirations often lead to significant price swings, volatility, and changes in trading volumes, making today a critical day for traders and investors.

Market Reaction to Options Expiry

According to Greeks.live, today’s expiration involves 139,000 Bitcoin options valued at $12.1 billion and 301,000 Ethereum options worth $2.13 billion.The put-call ratios—0.49 for Bitcoin and 0.39 for Ethereum—show a varying level of trader sentiment, indicating a more bearish outlook for Bitcoin compared to Ethereum. Bitcoin is currently trading at around $85,000, reflecting a 3% drop from earlier in the week.

Understanding Max Pain Points

A crucial aspect of options trading is the concept of max pain points. This is the price level where options sellers (market makers) experience the least financial loss upon expiration. For today’s options, Bitcoin’s max pain point is $85,000, while Ethereum’s is $2,400. Market makers often aim to steer prices toward these points, influencing the market’s direction. This strategy may partially explain Bitcoin’s recent decline as traders react to these technical levels.

Broader Market Sentiment and External Factors

The options expiration coincides with broader market concerns, including uncertainty over potential new tariffs from US President Donald Trump. This geopolitical tension has added to the selling pressure on Bitcoin and the crypto market as a whole. The compounded impact of today’s options expiry and external market pressures creates a complex and volatile environment.

Challenges Ahead for Investors

Greeks.live has cautioned that selling pressure is becoming more prominent in the cryptocurrency market, with traders facing challenges in the second quarter of 2025. Without fresh catalysts to drive prices higher, investors could encounter a turbulent market, making profitability challenging in the short term.

Preparing for Volatility

As the $14 billion options expiration unfolds, the crypto market remains on high alert. Traders and investors are closely watching price action to gauge the potential impact on Bitcoin and Ethereum’s future movements. With huge sums of money at stake, today’s market events could shape the trajectory of cryptocurrencies for weeks to come.

This high-stakes expiration is a reminder of the intricacies of the crypto market, where technical factors and external influences can align to create unpredictable outcomes. Investors must stay vigilant and adapt to the ever-evolving dynamics of the digital asset landscape.