- Bitcoin ETFs, including BlackRock’s IBIT, have faced a seven-day outflow streak, with $3 billion exiting as Bitcoin prices drop to yearly lows.

- Analysts suggest that hedge funds unwinding arbitrage trades are driving the sell-off, but historical trends indicate Bitcoin may recover despite the short-term downturn.

Bitcoin’s recent downturn has sent shockwaves through the market, with BlackRock’s iShares Bitcoin Trust (IBIT) experiencing its largest single-day outflow yet. Investors pulled a staggering $420 million from the fund on February 26 as Bitcoin slumped to yearly lows.

Record-Breaking Outflows Shake the Market

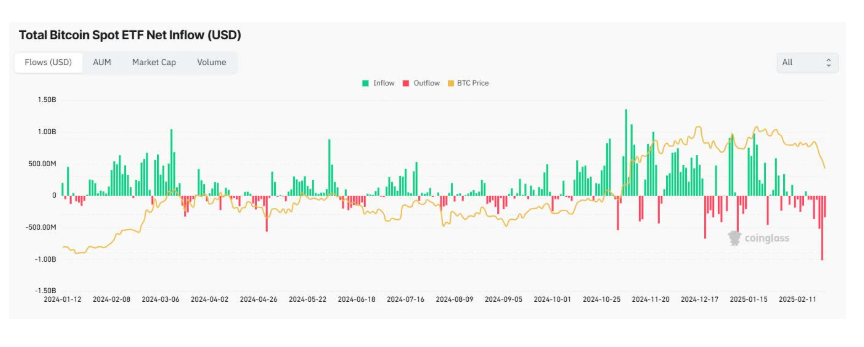

BlackRock’s IBIT shed 5,000 BTC in a single day, surpassing its previous record outflow of $332 million on January 2. This marks the seventh consecutive day of outflows, totaling nearly $3 billion across various Bitcoin ETF products. Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed a similar trend, with an additional $145.7 million exiting the product on the same day. Other major ETF providers, including Bitwise, Ark 21Shares, Invesco, Franklin, WisdomTree, and Grayscale, saw outflows ranging from $10 million to $60 million. In total, the day’s outflows reached approximately $756 million, according to preliminary figures from CoinGlass.

Bitcoin itself has seen a sharp decline, falling to $82,455 on February 26, contributing to a market-wide correction of 25%. Since its all-time high on December 17, the crypto space has lost $1 trillion in value, with total market capitalization now at $2.9 trillion. Despite these worrying numbers, industry experts urge investors to remain calm. Ki Young Ju, founder of CryptoQuant, warned against panic selling, reminding investors that Bitcoin saw a 53% drop in 2021 before rebounding to new all-time highs. He emphasized that a 30% correction is common in a Bitcoin bull cycle.

What’s Next for Bitcoin?

According to analysts, most Bitcoin ETF investors are hedge funds rather than long-term Bitcoin believers. These funds were initially drawn to Bitcoin ETFs for arbitrage opportunities, but as those yield opportunities diminish, they are now unwinding their positions. BitMEX co-founder Arthur Hayes and 10x Research’s Markus Thielen both suggest that these short-term traders are driving the sell-off, rather than true Bitcoin enthusiasts.

With Bitcoin currently facing continued selling pressure, analysts have mixed opinions on its short-term future. Hayes has predicted that Bitcoin could dip as low as $70,000 due to ongoing ETF outflows, while other traders are eyeing the $74,000 support level as a potential turning point. However, history suggests that Bitcoin has the resilience to bounce back. For investors willing to weather the storm, this downturn may present a buying opportunity rather than a reason to panic.