- Ripple, amidst a modest 0.06% gain for XRP, strategically filed a Motion for a Sur-Reply in response to the SEC’s Motion to Compel, heightening the intrigue in the ongoing legal battle.

- The SEC’s pursuit of penalties, Ripple’s defense strategy, and looming court deadlines in the final stages of the case add complexity to the XRP market, impacting investor sentiments.

In the latest episode of the legal tussle between Ripple and the U.S. Securities and Exchange Commission (SEC), XRP saw a marginal uptick of 0.06% on Wednesday, capping the session at $0.5184. This gain, although modest, marks a positive turn for XRP after enduring a 1.63% loss in the preceding session, breaking a streak of seven consecutive sessions in the red.

Ripple’s Legal Maneuver: Motion for a Sur-Reply

The spotlight intensifies on the courtroom clash between Ripple and the SEC as Ripple strategically files a Motion for a Sur-Reply on Wednesday. This move is in response to the SEC’s Motion to Compel, filed on January 11, which demanded Ripple to furnish post-complaint contracts governing XRP institutional sales and financial statements for 2022-23.

Ripple’s Opposition and What Lies Ahead

In a countermove on January 19, Ripple opposed the SEC’s Motion to Compel, setting the stage for a potential legal showdown. The Sur-Reply serves as an additional layer of response, with Ripple seeking to convince the court to deny the SEC’s Motion to Compel. If approved by Judge Torres, this would prolong the wait for a court ruling on the SEC’s motion.

The crux of the SEC v Ripple case centers around Ripple’s alleged breach of Section 5 of the 1933 Securities Act by selling unregistered securities to institutional investors. With the case reaching its final stages, both parties must conclude remedies-related discovery by February 12. Post-discovery, the focus shifts to arguments for and against punitive penalties for violating U.S. securities laws, with key deadlines outlined in the Court Briefing Schedule.

US Case Law and SEC’s Programmatic Sales Appeal

Analyzing the SEC’s pursuit of documents, it appears aimed at determining if Ripple continued violating securities laws post the December 2020 charges. However, potential limitations may arise from U.S. case law, particularly the Morrison v NAB ruling, confining SEC jurisdiction to XRP sales to U.S. institutional investors.

While the SEC v Ripple case unfolds, a looming challenge is the SEC’s plan to appeal against the Programmatic Sales ruling, potentially impacting the court’s stance. Recent rulings, such as Judge Jed Rakoff’s decision regarding TerraUSD and Luna, further add complexity to the legal landscape.

Market Indicators and Price Action

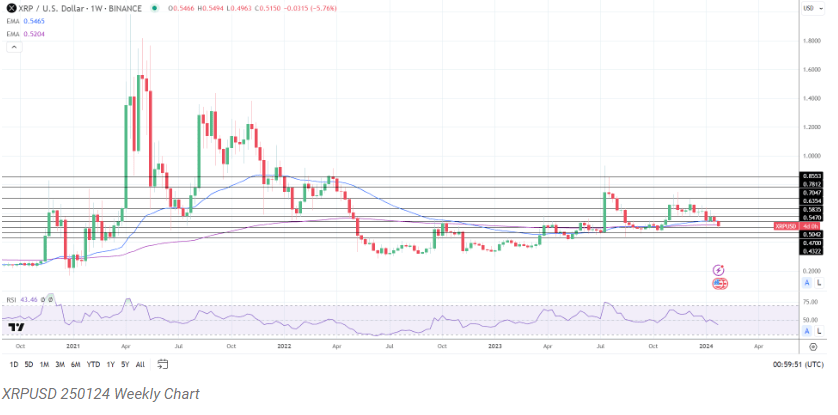

XRP’s market performance, as indicated by charts and metrics, reveals a bearish sentiment. The price action, with XRP below key EMAs and hovering near support levels, suggests a delicate balance. Investors are advised to closely monitor developments in the SEC v Ripple case and associated updates from the Coinbase litigation, as they may significantly influence XRP’s trajectory.

In the realm of cryptocurrencies, where legal battles can sway market sentiments, Ripple’s strategic legal moves and the SEC’s persistent pursuit of penalties keep investors on the edge, eagerly anticipating the next chapter in this high-stakes drama.