- Sui (SUI) may face a 20% price drop as it prepares to unlock $296 million worth of tokens on May 1, increasing sell pressure and diluting existing supply.

- Technical indicators also suggest weakening momentum, pointing to a possible short-term decline despite the network’s strong long-term potential.

Sui (SUI) is bracing for potential turbulence as a major token unlock event looms. On May 1, the network will release 88.34 million tokens—worth roughly $296 million—into circulation. This sudden supply increase is sparking concerns of a sharp correction, with analysts warning of a possible 20% drop in the short term.

ALSO READ:SUI Token Unlock on May 1st: $319 Million Release Poised to Impact the Market

Why the Upcoming Token Unlock Is Critical

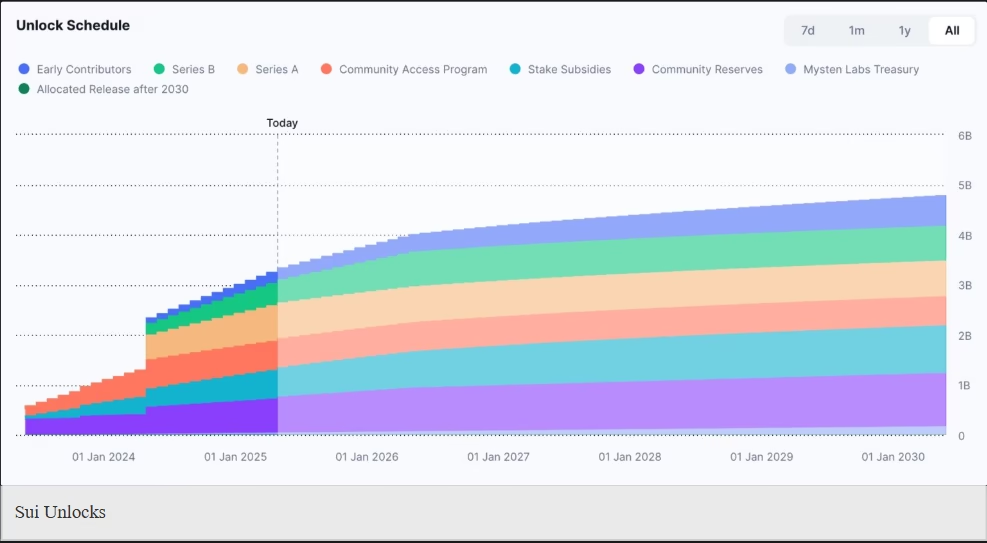

Token unlocks typically follow a vesting schedule and are not unexpected. However, this particular unlock is significant due to its sheer size and the current market setup. Most of the unlocked tokens are earmarked for Series B investors, with 19.32 million allocated to them directly. Another 14 million will go toward staking subsidies, while the rest will be distributed to early contributors and Mysten Lab Treasuries.

Given that SUI’s circulating supply currently sits at 3.24 billion with a total supply of 10 billion, this monthly influx of new tokens dilutes existing holdings and increases sell pressure—especially from early investors seeking to realize profits.

Bearish Technical Indicators Add to the Pressure

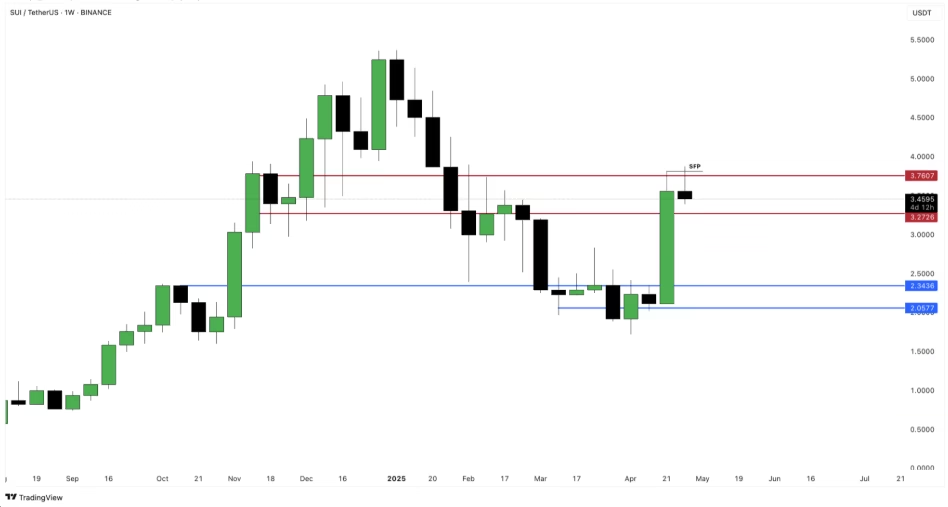

On the technical front, SUI is showing signs of weakness. After a strong rally in April—fueled by meme coin hype—the price reached a monthly high of $3.8690. However, the weekly chart now shows a potential evening star candlestick pattern forming, often a precursor to bearish reversals. A close around the $3.50 mark this week could confirm the pattern and signal further downside.

Adding to the bearish outlook, the four-hour chart reveals a double-top pattern near $3.811, along with weakening momentum indicators. The Relative Strength Index (RSI) has slipped below 50, and the Awesome Oscillator is approaching the zero line—both signals that buyers may be losing control.

How Low Could SUI Go?

If sell pressure accelerates following the token unlock, analysts predict SUI could fall to around $2.7377 in the short term. That would represent a 20% drop from current levels. A further dip to $2.3436—last seen in October—remains possible if bearish sentiment intensifies.

Despite near-term risks, Sui remains a strong player in the decentralized finance (DeFi) sector. The network has seen significant adoption and remains one of the more promising layer-1 platforms. While May’s token unlock may test investor patience, the long-term bullish thesis for SUI is still intact—once the dilution pressures subside.

ALSO READ:Sui Flips Chainlink’s Market Cap After a 44% Price Surge in 7 Days

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.