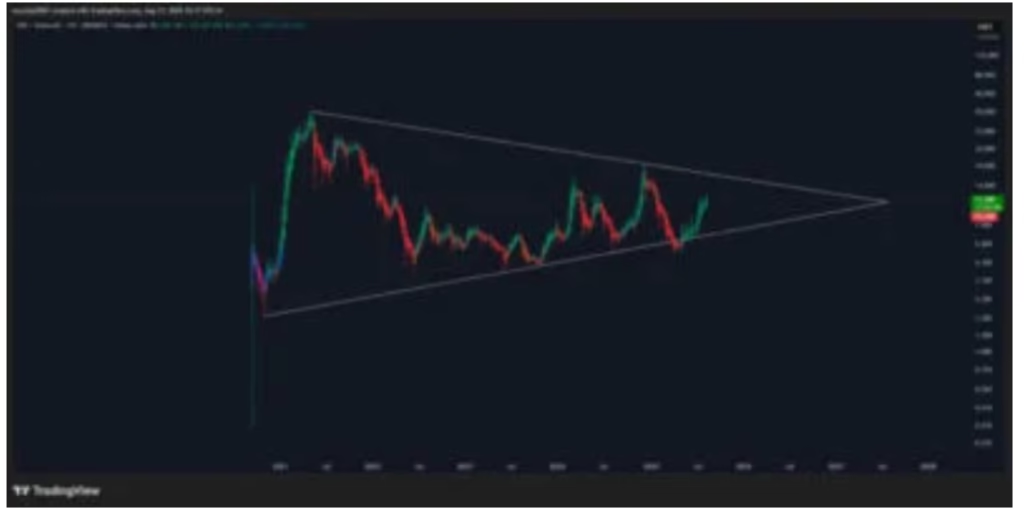

- Uniswap is consolidating within a symmetrical triangle, signaling a potential breakout that could push prices toward $15.

- Rising volume, bullish MACD, and positive CMF readings support the case for continued upward movement.

Uniswap ($UNI) is approaching a pivotal moment on the charts, with technical indicators pointing toward a possible bullish rally. A triangular consolidation pattern has formed, hinting at an imminent breakout that could drive prices toward the $15 mark if confirmed.

Uniswap Breakout Looms in Symmetrical Triangle

Analyst CW highlights a classic symmetrical triangle pattern in UNI’s price action, where highs and lows are tightening toward an apex. This setup signals that a decisive move is around the corner. If UNI breaks above the upper resistance line with strong trading volume, it could trigger a significant rally. On the flip side, failure to do so may result in a pullback and further consolidation near lower support levels.

Traders should closely monitor volume spikes since confirmation of a breakout would strengthen the case for an extended uptrend.

Steady Gains Backed by Volume

UNI’s recent price climb from $10.80 to $11.09 reflects consistent growth supported by increasing trading volumes. This gradual rise suggests investor accumulation and confidence in the asset. Holding above the critical $11 threshold could open the door for UNI to test higher resistance zones.

If buying pressure remains strong, UNI may overcome these resistance levels, reinforcing the bullish case. However, rejection at this level could extend sideways trading.

Uniswap Technical Indicators Strengthen Bullish Case

Key indicators also support the upward outlook. The MACD line has crossed above the signal line, accompanied by positive histogram bars, signaling short-term bullish strength. This suggests that UNI’s uptrend is gaining traction.

Additionally, the Chaikin Money Flow (CMF) stands at 0.07, above the neutral line, showing steady capital inflow into UNI. The combination of bullish MACD signals and positive CMF readings indicates increasing buying pressure and growing optimism for sustained price appreciation.

Outlook: UNI Could Push Toward $15

Uniswap’s symmetrical triangle formation, rising trading volumes, and supportive technical indicators combine to paint a strong bullish picture. If UNI breaks resistance with robust volume, the path toward $15 becomes increasingly likely.

For investors and traders, staying alert to volume surges and breakout confirmations will be crucial in navigating the token’s next move. With positive momentum building, UNI may soon enter the next phase of its price evolution.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.