- The market behavior of Cardano (ADA), highlights its unique trend of loss-taking amidst profit-taking observed in other cryptocurrencies like Bitcoin and Ethereum.

- Despite this, Cardano shows resilience and potential for upward movement, contrasting with possible peaks for other top coins.

Cryptocurrency markets are often a tumultuous landscape, with assets rising and falling on a tide of investor sentiment. In recent times, amidst the whirlwind of profit-taking and bullish rallies, Cardano (ADA) stands out as a unique case, with loss-taking dominating the scene.

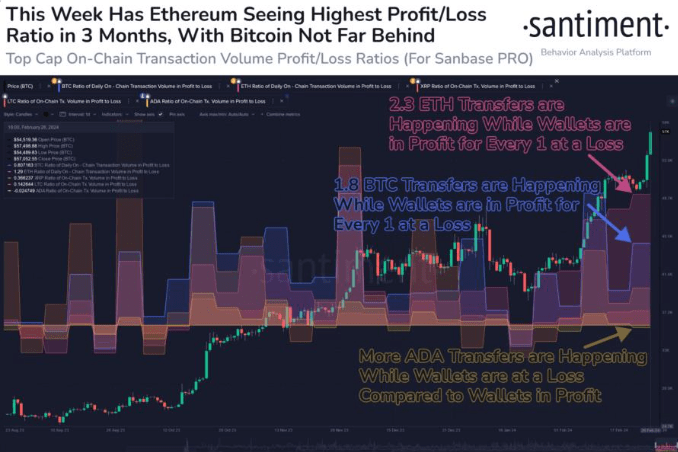

While Bitcoin (BTC) and Ethereum (ETH) bask in the glow of profit-taking, Cardano finds itself navigating through a sea of capitulation. Data from on-chain analytics firm Santiment reveals a telling story: while BTC and ETH witness investors selling at profits, Cardano experiences the weight of loss-taking outweighing profit-taking.

The key metric at play here is the “Ratio of Daily On-Chain Transaction Volume in Profit to Loss,” which provides insights into the balance between profit and loss-taking activities within a cryptocurrency’s ecosystem. This ratio unveils intriguing dynamics across different crypto assets.

A glance at the trend lines exposes the stark contrast in behavior. BTC and ETH boast positive values, indicating a prevalence of profit-taking transactions. Ethereum, in particular, emerges as a frontrunner, with a ratio of profit-taking transactions far outpacing underwater movements.

Cardano, however, paints a different picture. Loss-taking eclipses profit-taking, hinting at a phase of capitulation among investors. This trend suggests a divergence in sentiment compared to its peers, possibly driven by market dynamics unique to Cardano.

Historically, such dominance of profit-taking has signaled potential tops for cryptocurrencies, while periods of loss-taking often pave the way for market bottoms. Cardano’s lag behind other top coins in this metric hints at a potential for upward movement, contrasting with possible peaks for BTC and ETH.

ADA Price on 1st March 2024

Despite its struggles, Cardano’s performance remains resilient. With a modest 14% gain over the past week and trading around $0.66, ADA demonstrates resilience amidst market turbulence. This resilience, coupled with the potential for a shift in sentiment, positions Cardano as a coin to watch in the ever-evolving crypto landscape.

While Cardano grapples with loss-taking amidst a sea of profit-taking, its unique market behavior hints at underlying dynamics that may shape its future trajectory. As investors navigate the complex currents of the crypto market, understanding these nuances becomes paramount in making informed decisions.