- XRP and XLM both enable fast, low-cost cross-border payments, but XRP targets institutions with a semi-centralized model while XLM focuses on decentralized, peer-to-peer financial inclusion.

- XRP offers greater institutional adoption and growth potential, whereas XLM emphasizes accessibility and grassroots utility.

As blockchain tech reshapes the global financial system, two cryptocurrencies have emerged as leaders in the payments sector: XRP (Ripple) and XLM (Stellar). Both coins promise fast, low-cost cross-border transactions, but their visions, technology, and target users diverge sharply. So, which one is better suited for the future?

Two Coins, One Origin – But Different Paths for XRP and XLM

Both XRP and XLM were co-founded by Jed McCaleb, yet their direction split early. Ripple (XRP) targets financial institutions, offering enterprise-grade solutions for global payments, while Stellar (XLM) focuses on decentralized finance for individuals, especially the unbanked.

XRP operates through Ripple Labs and uses the Ripple Protocol Consensus Algorithm (RPCA)—a system efficient but criticized for being semi-centralized due to Ripple’s control over validator nodes. Stellar, managed by the Stellar Development Foundation (SDF), runs on the Stellar Consensus Protocol (SCP)—a more decentralized, trust-based mechanism.

Performance and Energy Efficiency

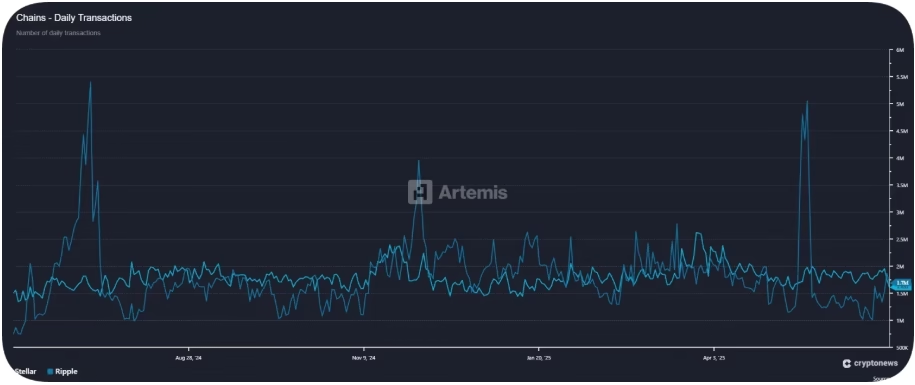

Both networks are lightning fast, settling transactions in 3–5 seconds with fees nearly zero. XRP handles 1,500 TPS, while Stellar supports 1,000 TPS.

In terms of energy usage, XLM is slightly greener, consuming 0.00022 kWh per transaction, compared to XRP’s 0.0079 kWh.

Use Cases and Adoption

Ripple has established strong ties with over 100 banks and payment providers, including Santander, American Express, and SBI Remit. Its infrastructure supports large-scale institutional transfers, DeFi integration, and even boasts its own USD-backed stablecoin (RLUSD).

In contrast, Stellar’s grassroots approach emphasizes financial inclusion. It partners with MoneyGram, IBM, and others to offer peer-to-peer payments, stablecoin ramps, and real-world asset tokenization.

Regulation and Market Position

Ripple’s history with the U.S. SEC has been tumultuous, but its 2025 settlement and potential ETF approval are seen as bullish. XRP trades at $2.17 with a $128B market cap, while XLM, priced at $0.28, focuses more on utility than speculation.

Despite criticisms over centralization, XRP is poised for significant institutional growth, especially if it captures even a fraction of the projected $250 trillion global payments market by 2027.

Final Verdict: XRP or XLM?

If you prioritize decentralization and grassroots use, XLM is the better fit. But for investors seeking growth potential backed by institutional integration and regulatory clarity, XRP stands out.

Both play vital roles in bridging traditional finance with blockchain innovation—yet their paths offer distinct opportunities depending on your goals.

ALSO READ:Stellar in 2025 – Key Factors That Will Influence XLM Value

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.