- Analysts Balchunas and Seyffart express 90% confidence in a January 10 approval for a Bitcoin ETF but caution a 10% chance due to a potential SEC need for more time, not an outright rejection.

- Balchunas anticipates possible lawsuits if the SEC denies the ETF. Despite the unlikely outright rejection, recent public letters express concerns about Bitcoin’s misuse, emphasizing the ongoing importance of regulatory scrutiny.

The cryptocurrency community is abuzz with speculation as the January 10 deadline for a potential approval of a spot Bitcoin exchange-traded fund (ETF) by the Securities and Exchange Commission (SEC) approaches. Bloomberg ETF analyst Eric Balchunas has provided valuable insights, emphasizing the likelihood of approval but not ruling out the slim chance of a significant setback.

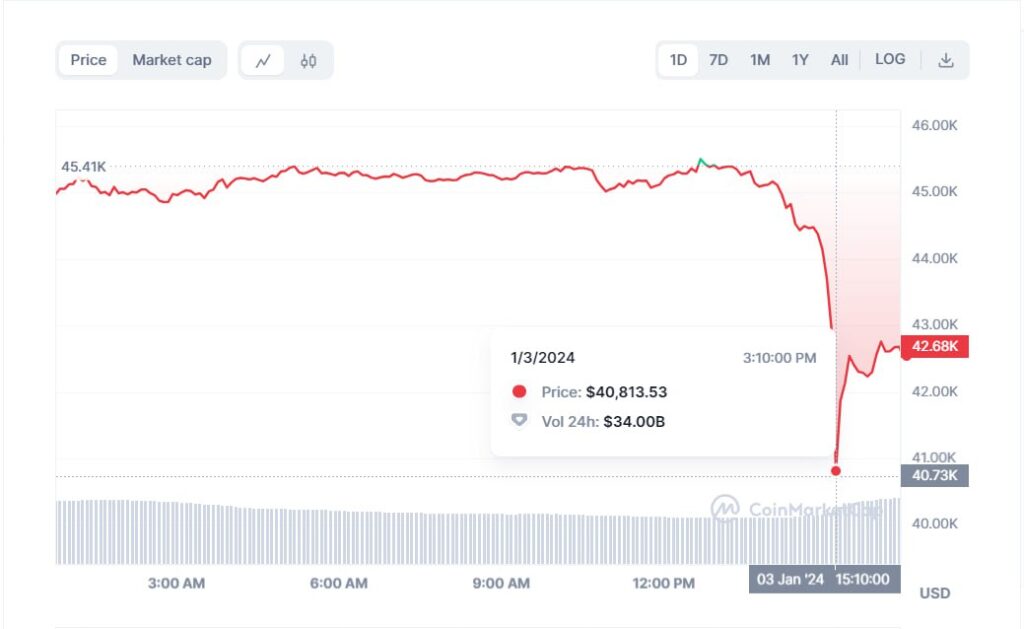

Bitcoin has moved to as low as $40,800 in just one hour after the news broke. The coin has however recovered within the last hour and is trading at around $42,500 at the time of reporting.

Assessing the Slim Chance of a SEC Rejection

Balchunas acknowledges the remote possibility of the SEC delivering the “rug pull of a decade.” In a recent interview with Cointelegraph, he expressed his belief that if a rejection occurs, it’s more likely due to the SEC seeking additional time rather than an outright denial.

Potential SEC Extension: More Time or Outright Denial?

While Balchunas and fellow analyst James Seyffart maintain a 90% chance of approval, they hesitate to raise the odds further. The concern centers around the SEC’s potential need for more time. Balchunas suggests that if the decision doesn’t come within the next two weeks, it’s likely because the regulatory body requires additional time for deliberation.

Balchunas’ Perspective: 90% Approval, but 10% Rug Pull Concern

Balchunas remains optimistic about the approval prospects but emphasizes the need for caution. He highlights that the 10% chance of a setback encompasses various scenarios. However, the significant investment of time and effort by both the SEC and Bitcoin ETF issuers makes an outright rejection less probable.

The Unlikely Scenario: A Last-Minute Rejection

Balchunas underscores the unprecedented efforts invested in the approval process, especially over the holidays, making a last-minute rejection seem unlikely. Describing it as the “rug pull of the decade,” he emphasizes the extensive work put in by all parties involved.

This would be the rug pull of the decade.

Vetle Lunde’s 5% Rejection Outlook: A Market Report Analysis

Adding to the discourse, Vetle Lunde, an analyst from crypto research firm K33 Research, offers a similar outlook with a 5% chance of rejection, suggesting a relatively low probability of a negative outcome.

Fallout of an Outright Denial: Lawsuits and Continued Struggle

Balchunas speculates that in the event of an outright denial, fund issuers might take legal action against the SEC, mirroring the response of crypto asset manager Grayscale in the past. The significant investment and efforts put forth are expected to drive continued efforts for ETF approval.

SEC’s Call for Public Feedback: Recent Developments and Concerns

As the SEC continues to solicit public comments on the ETF filings, the community remains engaged. Recent letters submitted on January 2 express concerns about Bitcoin’s decentralized nature, suggesting potential misuse by authoritarian regimes seeking to evade sanctions and control citizens.

While the likelihood of a Bitcoin ETF approval remains high, the cryptocurrency community is vigilantly watching for any unexpected developments in the coming weeks. The intersection of regulatory scrutiny, public feedback, and industry efforts makes this a pivotal moment for the future of Bitcoin in traditional financial markets.

+ There are no comments

Add yours