- Bitcoin experienced a temporary dip to $41,707, prompting concerns due to factors like increased supply on exchanges and whale profit-taking.

- However, signs of recovery are emerging, with key support zones, positive on-chain data, and institutional accumulation suggesting a potential bounce-back for the cryptocurrency.

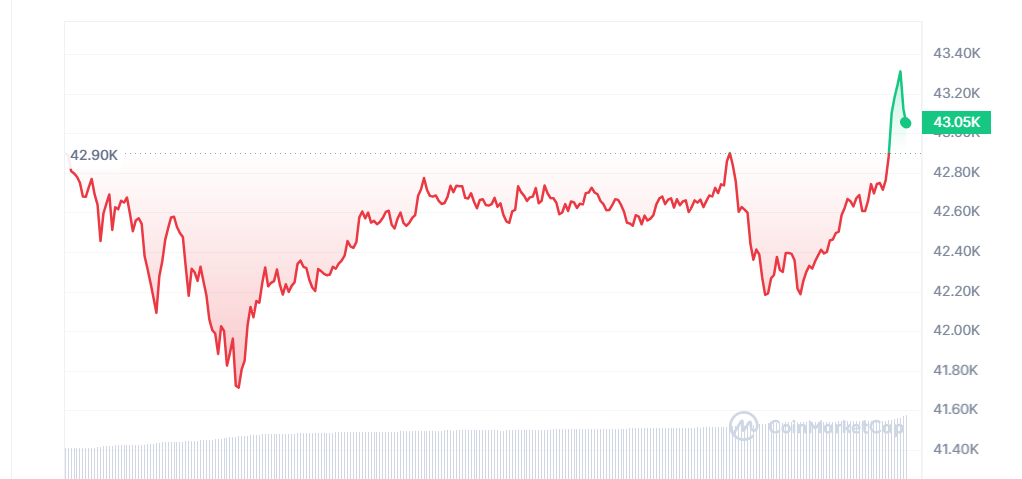

Bitcoin faced a challenging period as its price plummeted to $41,707, triggering concerns among investors. However, a swift comeback above $43K today on Monday suggests a potential recovery for the leading cryptocurrency. The recent dip was attributed to various factors, including rising Bitcoin supply on exchanges, profit-taking by whales, and the SEC’s “sell the news” response to BTC Spot ETF approvals.

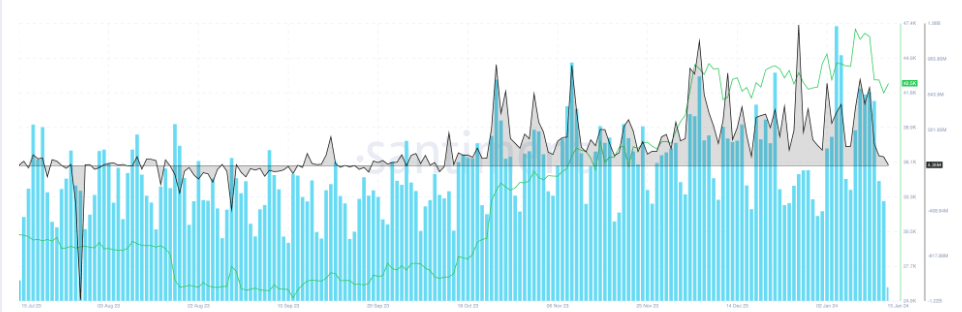

Santiment data revealed that Bitcoin whales engaged in profit-taking as the price slipped from $46,900 to $41,700. This contributed to the shift in the BTC Fear and Greed index from extreme fear to a neutral stance. Despite the decline, on-chain data indicates that 79.33% of BTC wallet addresses are currently profitable, hinting at potential positive momentum.

A notable observation by crypto expert Luke Broyles suggested that BlackRock could surpass MicroStrategy in Bitcoin ownership by February 1 if the current accumulation rate persists. This accumulation by institutional players, particularly ETF issuers, could be a driving force for Bitcoin’s recovery, according to analysts.

Bitcoin’s current position in the support zone ($41,417 to $43,345) is crucial, with 2.93 million addresses acquiring 991,100 BTC, as per IntoTheBlock data. The next target to the upside is identified at the $43,345 level.

Factors contributing to the recent price drop include the increased supply of Bitcoin on exchanges, rising from a six-month low of 5.30% on January 7 to 5.39% on Monday. Typically considered bearish, this rise in supply may induce selling pressure. Large wallet addresses taking profits, as evident in whale transactions and the Network Realized Profit/Loss metric, further added to the downward pressure.

Technical analysis suggests that Bitcoin’s price fell below its 10-day and 50-day Exponential Moving Averages (EMAs) at $43,710 and $42,094, respectively. Despite this, the cryptocurrency’s resilience was highlighted by finding support at $41,707. The path to recovery faces resistance at the 50% Fibonacci retracement level of $43,074, while a daily candlestick close below the 38.2% Fibonacci retracement level at $36,747 could challenge the bullish thesis.

In conclusion, Bitcoin’s recent challenges may be turning a corner, with key support zones, positive on-chain data, and institutional accumulation potentially setting the stage for a recovery. Investors are now closely watching for signs of strength above the resistance levels to confirm the cryptocurrency’s bullish momentum.

+ There are no comments

Add yours