- Bitcoin faced a challenging start to the week as a surge in Ordinals minting led to a 2% dip in its price during Asia trading hours, settling at $41,189.

- This mirrored the previous week’s trend, with other major cryptocurrencies like Ethereum, Solana, Cardano, and Avalanche also experiencing losses ranging from 2% to 5%.

Just over 24 hours ago, Bitcoin faced a tumultuous start to the week as a surge in Ordinals minting led to a congested blockchain network over the weekend. The flagship cryptocurrency’s price dipped by approximately 2% during Asia trading hours to $41,189, mirroring the previous week’s trajectory.

The impact wasn’t limited to Bitcoin alone, as other major alternative cryptocurrencies such as Ethereum, Solana, Cardano, and Avalanche also experienced significant losses ranging from 2% to 5% during the same trading period.

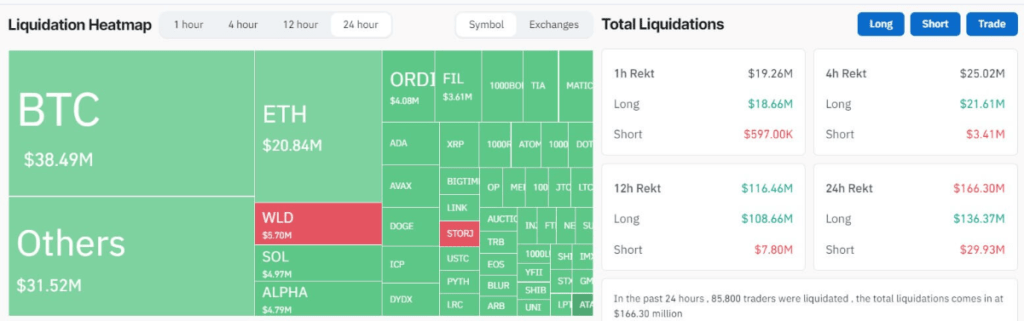

The recent price decline resulted in approximately $166 million in losses for around 85,000 crypto traders with active market positions, as reported by Coinglass data. Long traders bore the brunt of these losses, accounting for $136 million, while short traders faced $30 million in liquidations.

The Loss

Bitcoin and Ethereum, being the primary players, saw losses exceeding $40 million, with long positions contributing $38 million and short positions accounting for $7 million. Binance and OKX were the hardest-hit exchanges, recording liquidations exceeding $74 million and $42 million, respectively. Notably, a $10 million long bet on Bitcoin’s price through BitMEX marked the most significant individual loss.

Despite the dip, Bitcoin maintained a low Liquidation Sensitivity Index (LSI) score of just $15.5 million USD/%. This suggests a reduced reliance on leverage compared to the 2021 bull run, which witnessed an average of $74 million liquidated per 1% change in Bitcoin’s price.

The weekend also witnessed a clogged blockchain network due to a surge in Ordinals Inscriptions, causing the average transaction fee on Bitcoin to surpass $37, according to BitInfoCharts data. The Mempool data indicated over 288,000 unconfirmed transactions at the time of writing.

Ordinals have been a topic of debate within the BTC community, with some purists contending that these assets exploit vulnerabilities in Bitcoin Core to spam the blockchain. Others argue that inscriptions are an evolutionary aspect of the blockchain network that will persist.

Interestingly, a similar trend was observed in Ethereum virtual machine (EVM)-compatible chains like Avalanche, Polygon, and Arbitrum. Users spent over $10 million in transaction fees on these assets over the weekend, according to a Dune analytics dashboard by Hildobby. The broader crypto market now watches closely as the industry navigates through this period of volatility and network congestion.

+ There are no comments

Add yours