- ARK 21Shares has enhanced its Ethereum ETF filing with a cash-creation model and provisions for Ether staking, aligning with recent trends in the crypto ETF space.

- This innovative approach aims to improve tracking ability while introducing new risks and opportunities for investors in the evolving market.

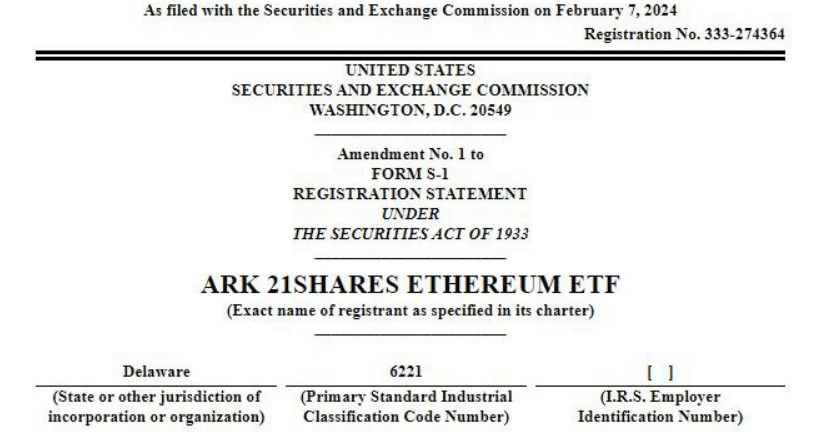

ARK 21Shares, a prominent player in the exchange-traded fund (ETF) arena, has recently made waves with its amended Ethereum ETF filing. This update introduces a cash-creation model and incorporates provisions for Ether staking, signaling a significant evolution in ETF strategies within the crypto space.

The Cash-Creation Model

The shift towards a cash-creation model, as observed in recently approved Bitcoin ETFs, aims to enhance the correlation between ETF shares and underlying assets. While this approach offers improved tracking ability, it also comes with potential cost implications that could affect investors. Nonetheless, the Securities and Exchange Commission (SEC) has shown a preference for this model, emphasizing its benefits in aligning market pricing with net asset value.

Ether Staking

ARK 21Shares is set to integrate Ether staking into its ETF framework. By staking Ether from the trust’s cold storage balances, the firm anticipates receiving staking rewards, which will be treated as income. However, this innovative strategy comes with inherent risks, including slashing penalties and lock-up periods for staked Ether.

The SEC is expected to make crucial decisions regarding multiple spot Ether ETF applications soon, with deadlines ranging from May to August. Despite optimism within the industry, Bloomberg ETF analyst James Seyffart has adjusted the likelihood of spot Ether ETF approval within the year, indicating a more cautious stance.

ARK 21Shares’ updated Ethereum ETF filing underscores the dynamic nature of the crypto ETF landscape, as firms seek to enhance tracking abilities and explore innovative strategies like cash creation and Ether staking. As regulatory decisions loom, the industry eagerly anticipates the potential implications for investors and the broader crypto market.

+ There are no comments

Add yours