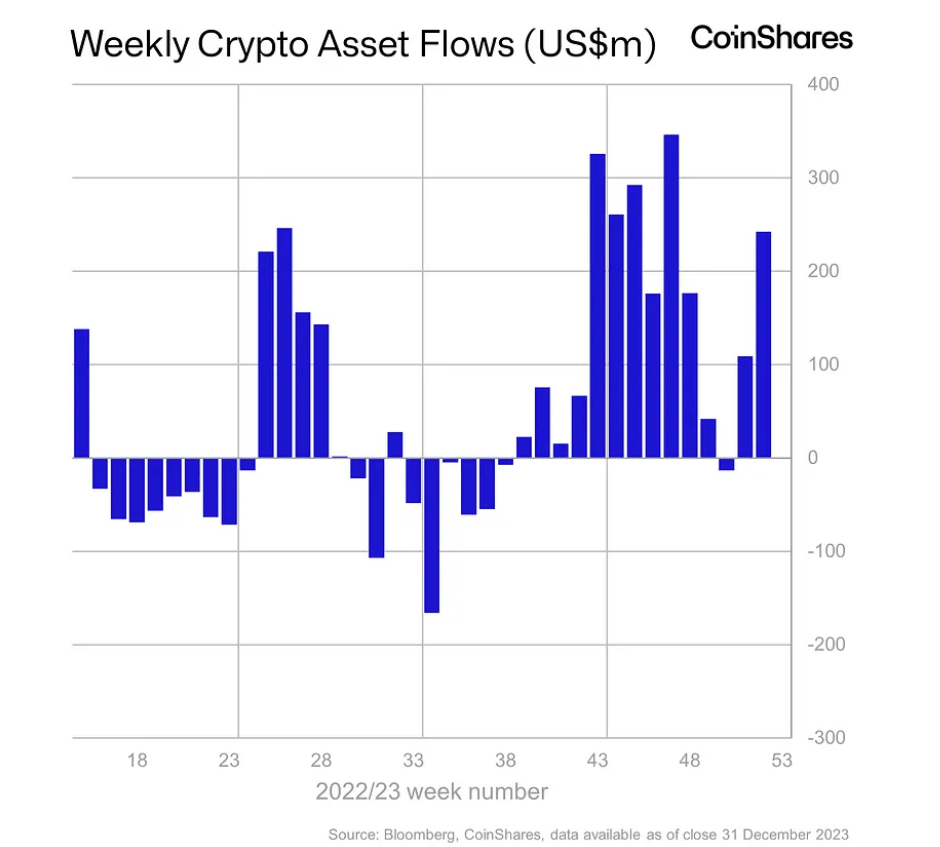

- In 2023, digital asset investment products experienced a remarkable resurgence, with $2.25 billion in inflows, marking the third-largest year since 2017.

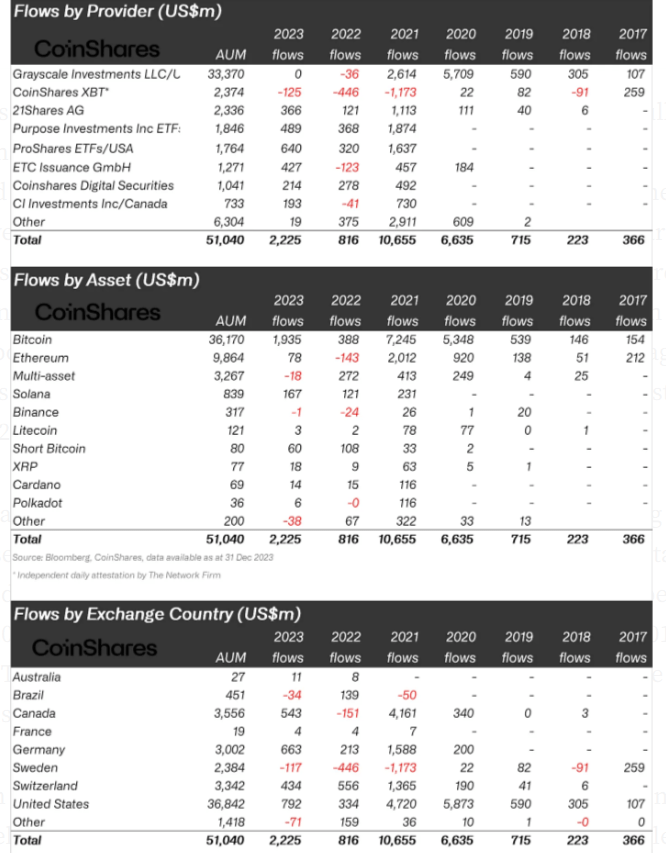

- Bitcoin dominated the landscape, attracting $1.9 billion, representing 87% of the total flows, while the sector witnessed a substantial turnaround, fueled by growing investor confidence and regulatory developments.

Digital assets made a splash in 2023, with a staggering $2.25 billion in inflows, marking a significant resurgence for the asset class. In our Digital Asset Fund Flows Weekly Report, we dive into the numbers that shaped the third-largest year for digital assets since 2017 and explore the factors driving this dramatic turnaround.

Bitcoin Dominance Soars as Investor Confidence Surges

2023 showcased a remarkable shift in sentiment, with inflows skyrocketing 2.7 times higher than those observed in 2022.

The final quarter played a pivotal role in this revival, as the SEC hinted at warming up to Bitcoin spot-based ETFs in the United States. The total assets under management (AuM) soared by 129%, reaching $51 billion by year-end—its highest point since March 2022.

Bitcoin emerged as the star player, attracting a whopping $1.9 billion in inflows, constituting a staggering 87% of the total flows. This dominance marked a historic high, surpassing the 80% peak observed in 2020. The surge in Bitcoin’s popularity may be attributed to the growing anticipation surrounding SEC ETF approval, reflecting a pattern of hype rather than a discernible trend.

Ethereum and Solana: A Tale of Recovery and Opportunity

Ethereum experienced a modest recovery, securing $78 million in inflows, yet it lags behind in the overall AuM share, holding only 0.7%. Meanwhile, Solana seized the opportunity presented by investor hesitation toward Ethereum, garnering $167 million in inflows, making up a notable 20% of AuM.

Global Trends: From the US to Germany

While the US led in terms of inflows with $792 million, it represented a mere 2% of AuM. Surprisingly, Germany took the lead in percentage terms, with 22% of AuM flowing into digital assets, followed by Canada and Switzerland at 15% and 13%, respectively. The US lag in inflows could be attributed to investor preferences for spot-based ETFs, shedding light on regional nuances in digital asset adoption.

Blockchain Equities Ride the Wave

It wasn’t just digital assets that enjoyed a prosperous 2023; blockchain equities also basked in the glory. AuM in this category surged by 109%, accompanied by total inflows of $458 million—3.6 times higher than 2022 figures. This robust performance underscores the growing interest and confidence in blockchain-related companies.

2023 was a pivotal year for digital assets, witnessing a remarkable comeback fueled by regulatory developments and growing investor confidence. As we head into 2024, the digital asset landscape continues to evolve, promising new opportunities and challenges for investors worldwide.

+ There are no comments

Add yours